✏️ Repo

✏️ Suppose that Rob needs money (he does!!!). Latania has money, but she doesn’t trust Rob. However, Rob has $1.1M of T-Bills. He needs to borrow $1M of deposits at the Fed. How would this work as a repo?

✔ Click here to view answer

In the first day, we need to get Latania’s money to Rob, so she buys Rob’s T-bills for $1M.

Day 1:

- Rob → Latania: $1.1M T-Bills

- Latania → Rob: $1M of deposits at the Fed Now, Rob has the $1M of cash that he needs. In return, Latania has $1.1M of T-Bills that she gets to keep if he ProblemA’t return her $1M.

In the second day, Rob needs to pay Latania back, so he buys his T-Bills back. He pays the initial $1M plus some interest.

Day 2:

- Rob → Latania: $1M + $1M*(the repo rate)

- Latania → Rob: $1.1M T-Bills.

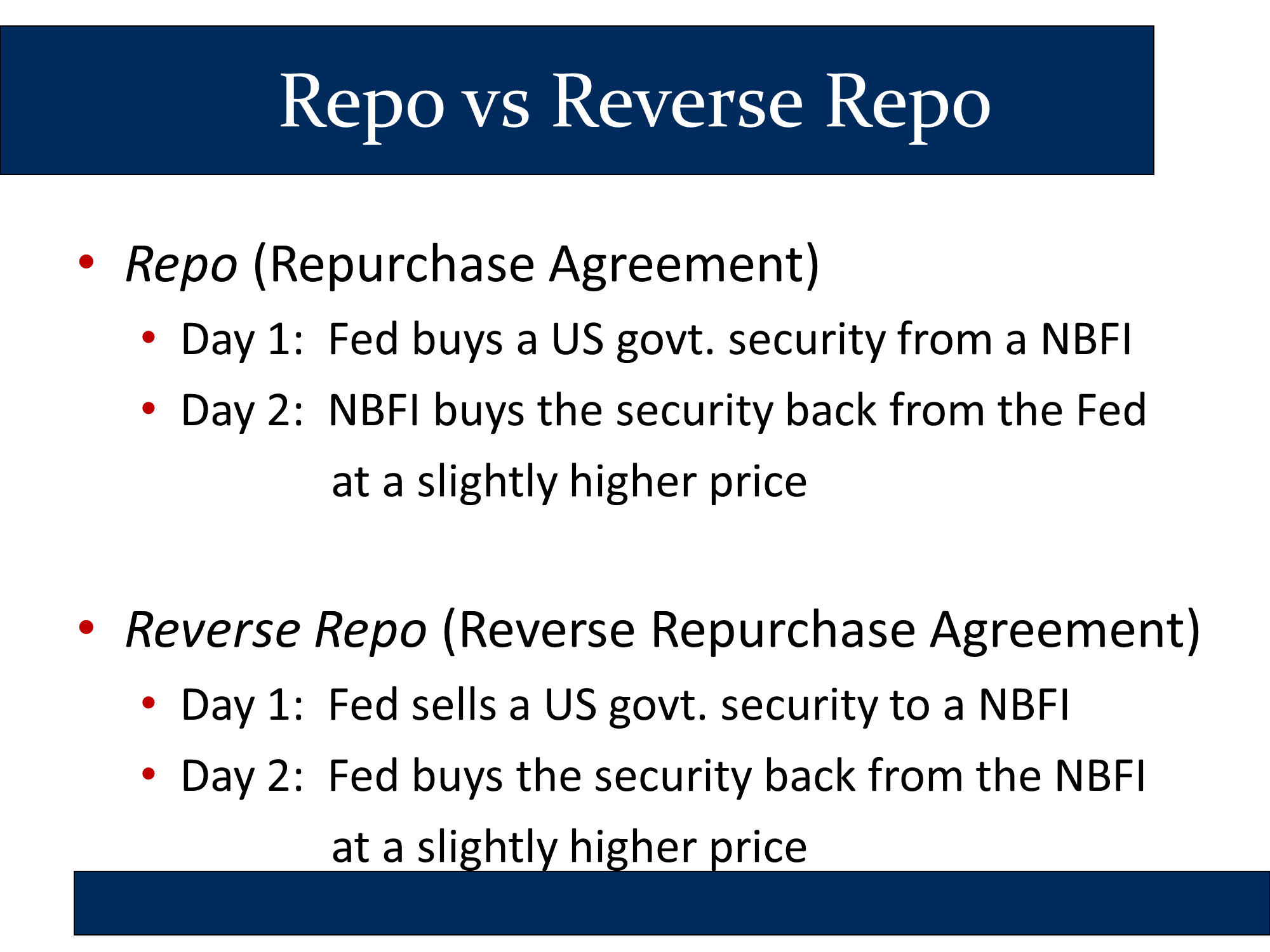

From Rob’s perspective, this was Repo. It’s repo for the borrower. From Latania’s perspective, this was Reverse Repo. It’s RRP for the lender.

RRP is a way of lending.

RRP is when the NBFI lends money to the Fed.

The Fed wants the NBFI to lend it money so that the NBFI ProblemA’t have the money and ProblemA’t lend it to anyone else.

The Fed is raising interest rates by getting the NBFI to lend money to the Fed rather than lending it to someone who might actually spend the money and worsen our inflation problem.

Why does the NBFI do the RRP? Because it is lending money and getting a competitive interest rate.

Why does the Fed do the deal? To ensure that the NBFI ProblemA’t lend the money out for less than the lower bound of the Fed Funds rate.

❔ Why do we assume that the value of the govt security - given to the NBFI as collateral - goes up? What if it goes down by the time the Fed has to buy it back? Or is it the case that the change in value does not matter? Is it the case that the ON RRP rate is the interest that the Fed pays the NBFI for borrowing some money, and the govt security is just collateral? And that whether the value of the collateral goes up or down is irrelevant, and just bad luck for the NBFI if it goes down by the time it gets it back? I would appreciate if you can go into the details on this.

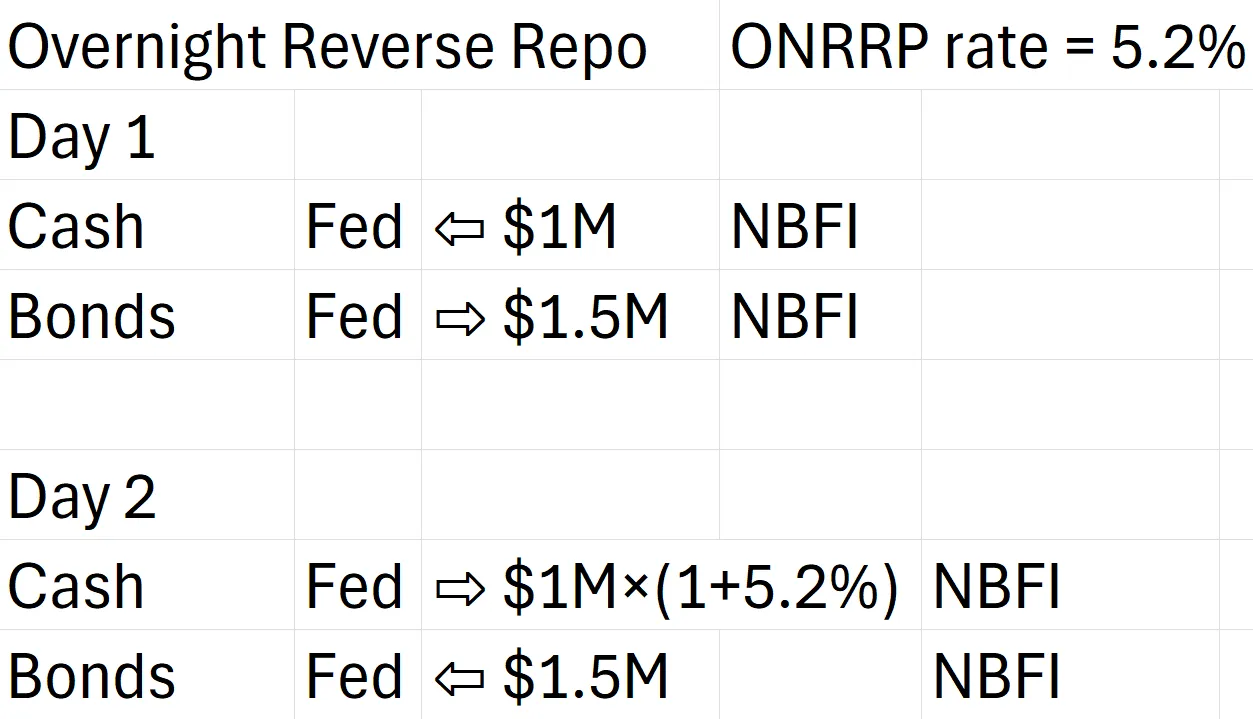

✔ We reviewed this example:

| Economic Way of thinking: The Fed is borrowing 1.5M of the Fed’s bonds as collateral. |

| Legally, what happens is known as a “Sales and Repurchase Agreement” (aka a Repo): The Fed sells 1M. However, it does this in the context of a contract that stipulates that on the next day, the Fed can buy the same bonds back for a price that is only 5.2% higher. |

The bond is just collateral and its actual value is immaterial because everyone knows that it will go back to the Fed at the end of the day. The only thing that matters in a repo transaction is that the value of the bond is higher than the amount of money being borrowed. This is what makes it good collateral.

What you wrote is exactly correct: “the ON RRP rate is the interest that the Fed pays the NBFI for borrowing some money, and the govt security is just collateral?”

Whether the value of the collateral goes up or down is irrelevant, and just bad luck for the fed if it goes down by the time the Fed gets it back? It’s bad news for the Fed because they were always the Fed’s bonds - they were essentially just pledged as collateral to the NBFI. To make the pledge of them as collateral have teeth, they are legally sold to the NBFI. That way, if the borrower, (in this case the Fed) were to go out of business or to try to steal the money, the lender (in this case the NBFI) would literally already own the collateral. It ProblemA’t need to go to court to get it and there is no uncertainty, because it already owns the collateral legally.