🔎 Callable Bonds

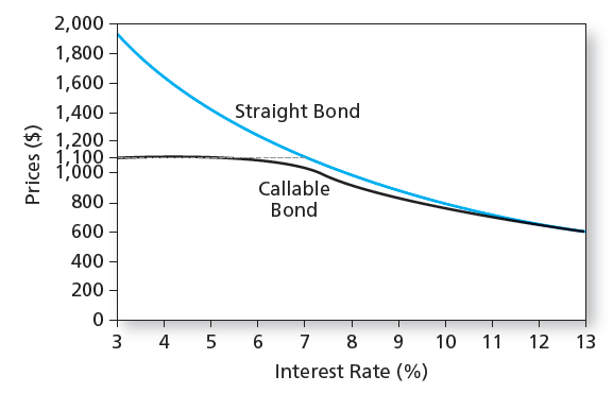

Imagine you are the CFO of a firm that has $120M of callable bonds outstanding. The yield on your other, non-callable (straight) bonds is 4%, even though the straight bonds have the same maturity and coupon rate, etc (the only difference is that they aren’t callable). Therefore, common sense would say that the yield on these bonds should be 4%. If you plugged 4% into the bond pricing formula, the bonds would be worth $1600. But they’re not. Their worth only $1100. Why?

Well, as you look at the two classes of bonds, you note that you must make the same payments on both bonds.

So here is what you do. You call the callable bonds and then issue $120M of straight bonds. This not affect your cash position because you are issuing new bonds to raise all the money you spent on calling the old bonds.

However, because you received $1600 on the newly issued bonds and only paid $1100 on the bonds you are calling, you don’t have to issue as many bonds as before.

You end up with fewer bonds outstanding, which means fewer debt payments.

GREAT.

In this situation, any savvy CFO would call the bonds and replace them with newly issued bonds.

The market knows this, so it will expect the bonds to be called. In other words, investors expect their bonds to be “called for $1100.” This is why the value tops out at $1100.

Details:

30 year bond

8% coupon rate

$1,000 par value

I am following, but why would you want to get it in the first place as investor.

If you think that yields will rise, not fall, then you don’t have to worry about the bonds being called. AND the callable bonds are always a bit cheaper for the same cash flows. If you aren’t worried about the bond being called, definitely buy the callable bond.

That’s one reason. Another reason goes back to asymmetric information. Issuing callable bonds is a form of signaling. Management knows the quality of the firm, and if management thinks that the company’s yields will fall, that is a good sign. It makes the bonds more valuable. But note, Call option on a bond literally is a call option. They are able to buy the bond at a fixed price the call price. That option is only valuable if they expect yields to drop. Therefore, issuing callable bonds is like the CFO saying, “We think our yields will drop, and we’re going to essentially ask for a call option on our bonds.” It’s a statement of confidence and a positive signal.