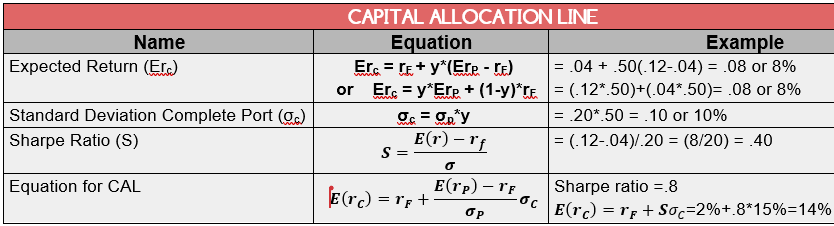

Key Formulas with explanations and concrete examples

Here is a link to the full formula sheet: https://robmunger.com/1452share

First Equation: Expected Return

↑ : “The expected return for your/the client’s complete portfolio.” Basically, if you have any portfolio that consists of a risky asset and a risk-free assets, if you want to calculate its expected return (ie how much money we will make, on average), then we use this formula.

↑ : is always just the risk free rate.

↑ : is just the proportion of the portfolio that is invested in risky assets. You want to divide the entire portfolio into risky and riskless assets. Think of all of the risky assets as being one “sub-portfolio” and all of the riskless assets as being another “sub-portfolio.” ‘y’ is simply the percentage of your portfolio that is invested in the risky assets - in other words, it is the percentage of your portfolio that is invested in the risky portfolio.

↑ : The return on the risky portfolio is , so its expected return is . Let’s pretend that the risky portfolio for my wife is the Vanguard Target date fund. Therefore, is the actual return on that fund. Of course, we don’t know what the actual return on that portfolio will be (a mutual fund, after all, is a portfolio of assets). However, we do need to make investment decisions today. Therefore, we make our decisions based on our expectations for the return of the portfolio. Personally, my best guess for the return on that fund is 9.5% annually. Therefore, for me, .

↑ Normally, we think of as the return on T-bills, but you might also have a portfolio of assets that are your risk free assets. You can think of as the return on that portfolio of assets. You can always just think of as the return on T-bills. The important thing is just to “read the room” as you look at a problem.

✏️ Nat has a ridiculous amount of money in a hedge fund. The only other asset he has is a money market mutual fund that only invests in T-bills (and is perceived to be risk free). The return on the money market fund will be 3% and expected return on the hedge fund is 12%. He has 10% of his money in the money market fund. What is his expected return?

✔ Click here to view answer

✏️ Nat is not happy with a return of 11.1% and feels his life would have more meaning if the expected return on his portfolio was 11.0%. What percent of his money should be invested in the hedge fund if this is his goal?

✔ Click here to view answer

To “read the room” just remember that this is probably just an application of the same formula.

Plug and chug: help

- Equation →

- Plug 🔌 →

- Solve 🚂 →

- 🧠 → He should invest 88.89% in the hedge fund. This makes sense because when he invested 90% in the hedge fund, he had slightly higher returns.

Next Equation: Standard Deviation

↑ This is the standard deviation of the full portfolio. It is a measure of the risk that Nat is exposed to.

↑ : This is the standard deviation of the hedge fund.

↑ : As before, this is the proportion invested in the risky asset.

✏️ Suppose that the standard deviation of the return on the hedge fund is 15.00%. What are the standard deviations of the two portfolios discussed above?

✔ Click here to view answer

The hedge fund is Nat’s risky portfolio in this question, so and

With the first portfolio:

With the second portfolio:

✏️ Suppose that Nat is a bit moody and really prefers round numbers. He would like a standard deviation of exactly 13%. What percent of his assets should be invested in the hedge fund?

✔ Click here to view answer

Plug and chug: help

- Equation →

- Plug 🔌 →

- Solve 🚂 →

- 🧠 → This makes sense. To decrease Nat’s risk slightly, just decrease the proportion of risk assets slightly.

✏️ What is the variance of Nat’s first complete portfolio, with ?

✔ Click here to view answer

Variance =

Variance =

The variance is 0.018225 and the Standard Deviation is 13.5%.

Some practitioners will also write variance in “percent-squared:“

Variance = “percent-squared”

🙋♀️ How do I know whether to enter my answer as a decimal or as a percent squared?

See answer

✔ He’ll make it clear with clues in the phrasing of the question, like he would with percentages:

The SD of the first portfolio is .135 (enter your number as a decimal)

The SD of the first portfolio is 13.5%.

Similarly:

The variance of the first portfolio is .018225 (enter your number as a decimal)

The variance of the first portfolio is 182.25 percent squared.

Next Equation: Sharpe Ratio

Sharpe ratio of the risky portfolio:

Sharpe ratio of the complete portfolio:

You can take the sharp ratio of any asset by plugging a return and the standard deviation of that return into this formula:

For example, you can find the Sharpe ratio of various ETFs (Exchange Traded Mutual Funds) in Yahoo Finance on their risk tabs. Here are the Sharpe Ratios for several ETFs I sometimes mention as examples during section: SPY (the largest ETF, owning the largest 500 stocks in the US), VTI (a large ETF, covering the entire investible US stock market, roughly 4000 stocks), and BND (a large ETF, covering the entire investment-grade US bond market, roughly 10,000 bonds).

✏️ What are the Sharpe ratios for the three portfolios that Nat considered?

✔ Click here to view answer

Next Equation: The Equation For The CAL

✏️ Remember how Nat said that he wanted a portfolio with an SD of 13%. Your colleague, Julia, said that this portfolio would have an expected return of 11%. But you don’t trust her!! Use the formula to check her work.

✔ Click here to view answer

Portfolio returns as a mixture

✏️ Suppose that Nat’s hedge fund has a terrific year and has a return of 22%. He is invested 90% in it. What is his return this year? What is his excess return this year?

✔ Click here to view answer

Nat is invested in the hedge fund and in the money market fund.

Excess return

Excess return

Excess return

Nat’s Excess return

The hedge fund’s Excess return

In contrast, before you know the actual return, you can only estimate the Risk Premium,

Risk Premium

Risk Premium

Risk Premium

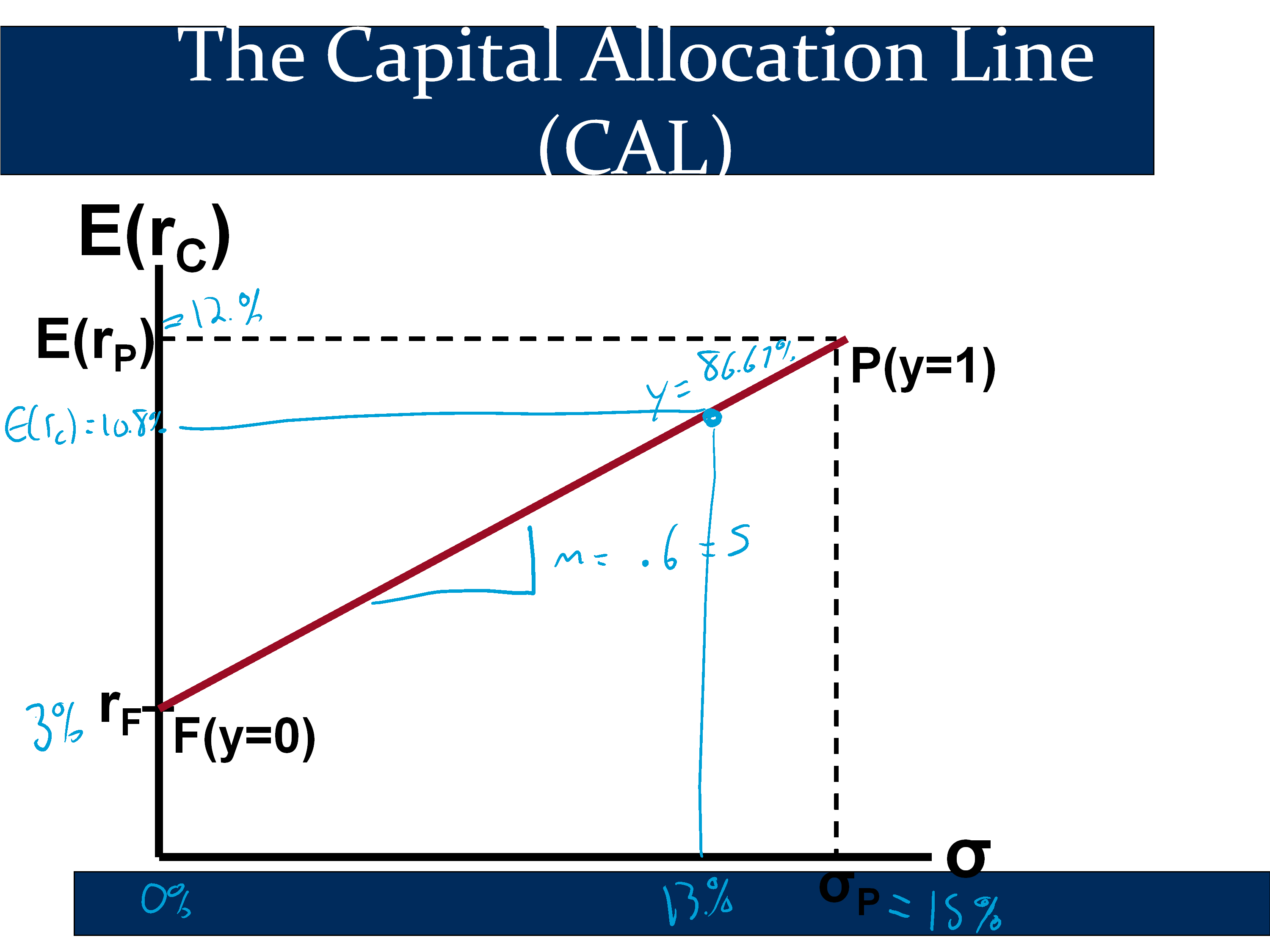

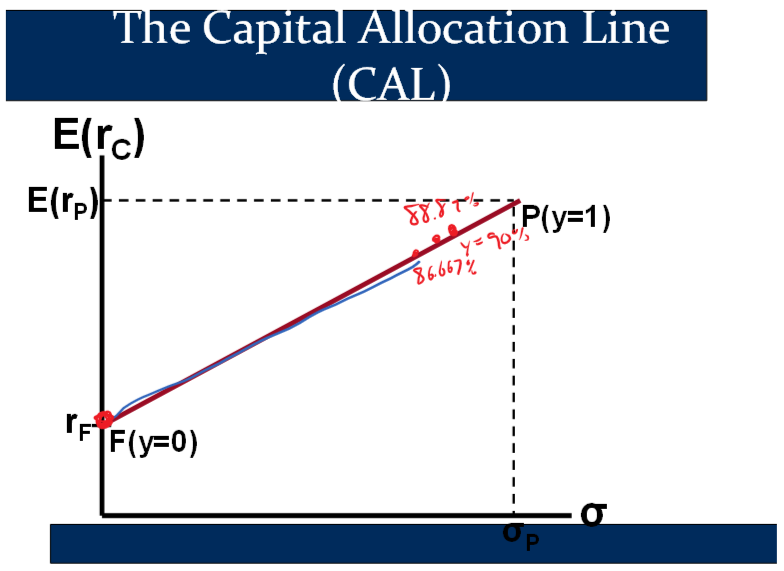

Graphing the CAL

✏️ Graph Nat’s CAL and illustrate Nat’s portfolio that has the

✔ Click here to view answer