🔎 Facts about Duration and Interest Rate

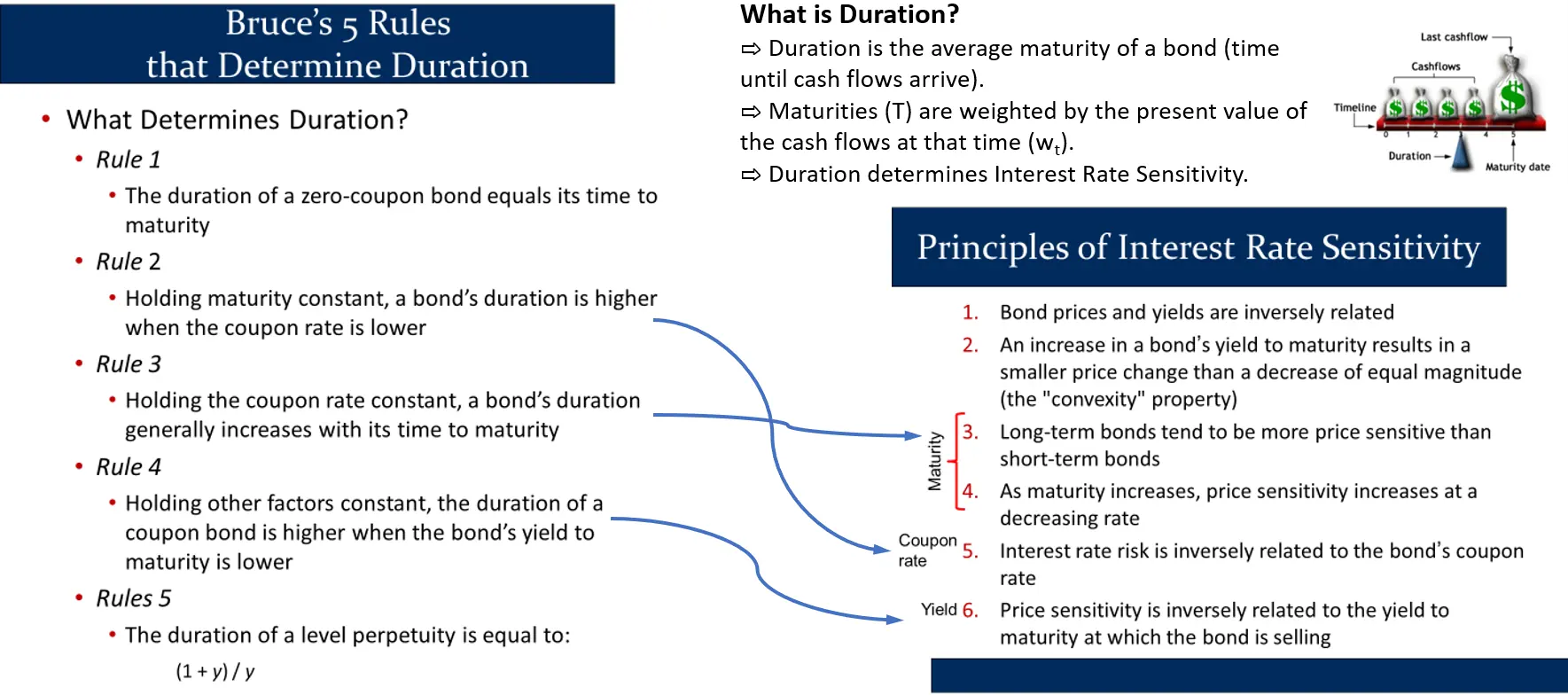

Bruce presents 6 Principles of Interest Rate Sensitivity and 5 Rules of Duration. It’s important to know all of them.

The best way to learn them is to see the interconnections between them and the definition of duration:

This page shows how

- The first four Rules follow from the definition of duration

- The last four Principles follow from three of the Rules and from another observation about duration

It also shows you how to visualize duration, based on its definition. Understanding these connections helps you to learn, remember and apply all 11 rules and principles.

Principle 1: Bond prices and yields are inversely related

This famous fact is the first thing any bond investor thinks of when they hear that “interest rates are changing.”

- When interest rates rise, bond yields also rise. As a result, bond prices fall.

- When interest rates fall, bond yields also fall. As a result, bond prices rise.

This is the foundation of interest rate sensitivity. It follows from the fact that the yields of similar bonds are used as discount factors to discount the prices of other bonds. When interest rates/yields increase, discount factors used to price bonds rise and bond prices fall.

Principle 2: Convexity

This principle just summarizes Bruce’s presentation about convexity.

Principle 2: An increase in a bond’s yield to maturity results in a smaller price change than a decrease of equal magnitude (the “convexity” property)

Basically, it says that when yields/interest rates rise, bond prices fall by a relatively small amount, but when yields/interest rates fall, bond prices rise by a relatively larger amount. It’s good news for investors!

Please let me know if you’d like any further review of Principles 1 or 2. They are don’t fit into this page well, but I am happy to review them.

Principle 3: Long-Term bonds are more price sensitive than short-term bonds

The key determinant of interest rate risk is the amount of time until the payments are received.

- When the payments will be received soon, interest rate sensitivity is low, because the money is almost in your hand.

- When the payments won’t be received for a while, interest rate sensitivity is high.

For simplicity, I will sometimes refer to the amount of time until a payment is received as the “maturity” of that payment.

Understanding the Rules and Principles by visualizing Duration

All 5 Rules of Duration follow from the definition of duration once you understand how to visualize duration.

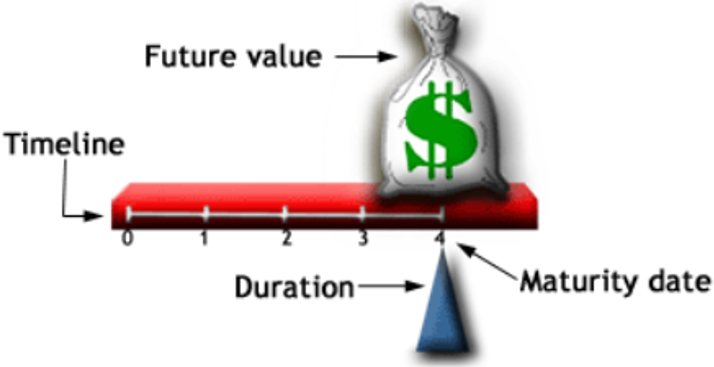

As mentioned in Principle 3, the most important determinant of interest rate risk is the time until the payments are received: the maturity of payments. Because of this, duration is measured in years and a timeline (the red bar, below) will be the starting point of duration calculations. The other main point of the calculations will be how much money is received at each point on the timeline.

Bruce introduces how to visualize duration using the following graphics:

| Normal Coupon Bond | Zero Coupon Bond |

|---|---|

|  |

The red beam is supposed to be balancing on the blue triangle. Anyone who has balanced a plate on their finger knows that to balance a plate, you put your finger in the middle of the plate. However, this red beam is not like a regular plate because it has bags of money adding weights at different points. Thus, the blue triangle, duration, represents the middle of the timeline - taking into account the size of the cash flows between now and the maturity date. (In fact, the red beam is meant to be weightless. The cashflows are the only thing you are balancing.)

Three conclusions arise immediately from thinking about duration this way. The first is that, for all bonds, duration will always be between 0 and T, the maturity date of the bond.

The second conclusion is that larger payments will have more weight, pulling the duration toward them. Imagine you are balancing a plate on your fingertip. One side of the plate has a heavy weight on it and the other side has only a light weight on it. To balance the plate, you’d move your fingertip toward the heavy weight to support that weight, right? Similarly, duration, the blue triangle, always moves toward the “heavier” cash flows. A simple conclusion arises out of this for duration: because of the large payment of par value on the maturity date, duration will be closer to T than to 0.

The third conclusion requires you to understand that you should think of the red beam, itself, as weightless. So imagining that you want to balance a weightless plate with a single heavy weight on it. You would put your finger right under the center of the heavy weight, right? Because if you didn’t, the plate would immediately tip toward the heavy weight and it would fall off your finger. This explains the graphic on the right. In it, there is only one large payment, and the blue triangle (duration) is right under it at the maturity date, T.

Once you recognize that the red beam is weightless, you can understand why the graphic on the right shows duration equal to the maturity date, T. Based on the above conclusion, we can see that

Which bond has higher Duration Cheat sheet:

- Rule1: if c=0 then dur=T

- Rule2: if c↑ then dur↓

- Rule3: if T↑ then dur↑

- Rule4: YTM↑ then dur↓

- Rule5: dur = (1+y)/y for a perpetuity

Rules 1 and 2 are consistent because duration is always between 0 and T. Therefore, a zero coupon bond has the highest duration possible.

- Principle1: if y↑ then PB↓

- Principle2: Convexity

- Principle3=Rule3: T↑ then price sensitivity↑

- Principle4: As maturity increases, price sensitivity increases at a decreasing rate.

- Principle5=Rule2: if c↑ then price sensitivity↓

- Principle6=Rule4: if ytm↑ then dur↓