🙋 Section/Student Qs for Lecture 6

Agenda for Saturday Section, July 20 ✅

- Slide Review, concentrating on the most important and challenging slides from this week’s lecture.

- Pages about this lecture on this website. Read 🧭 Getting Oriented for how to find them on the site.

- Office Hours. Click here for notes and timestamps. Email office hour questions to robecon1452@gmail.com and I will cover them next section.

Click here to learn about timestamps and my process for answering questions.

📅 Questions covered Saturday Section, July 20

🕣

❔ Not sure how to approach Question 7.

✔

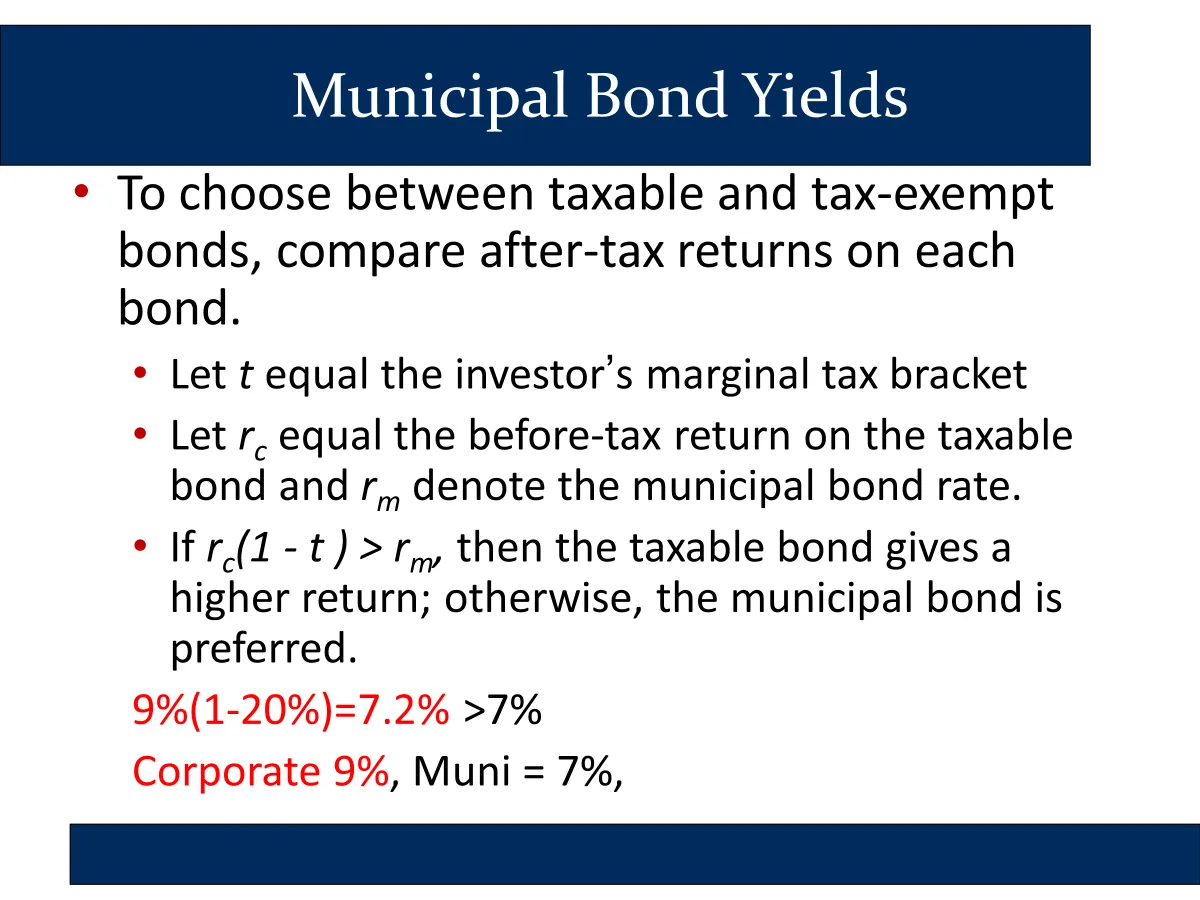

Why (1-t)?

🕣

❔

✔ Suppose you have a debt instrument with an interest rate of r and your marginal tax rate is MTR.

Suppose you invest $100. Your tax will be . Your after tax income will be To calculate a return on your original investment, you just divide by $100. In conclusion, whenever you want to know your final return (as a percentage), you just take your pretax return, r, and multiply it by (1-t).

When you multiply by (1-t), then, intuitively, the 1 refers to your interest income, and the t refers to the bite that is taken out of the interest income by taxes.

Slide

🕣

❔ Can you include that slide?

✔

bid and ask?

🕣

❔ If you want to find out how much you pay for a bond, how do you use the bid and ask?

✔ Historically, bonds have been sold by dealers. Dealers, also known as market makers, will publish prices at which they will buy and sell a given bond.

- The price at which they will buy a bond is the price they are “bidding” for the bond. Therefore, the highest price that a bond dealer is bidding for a bond is known as the “bid.”

- If you want to sell a bond, you receive the bid.

- The price at which they will sell a bond is the price they are “asking” for the bond. The lowest price that a bond dealer is asking for a bond is known as the “ask.”

- If you want to buy a bond, you will pay the ask. Generally, the bid will be lower than the ask.

s1452 Help Links: 👨💻

- General Info on sections and using this website.

- Email office hour questions to robecon1452@gmail.com. PS1Q2=“Question 2 of Problem Set 1”

- Slides with handwriting from section and other useful files