🔎 Duration explains interest rate risk sensitivity

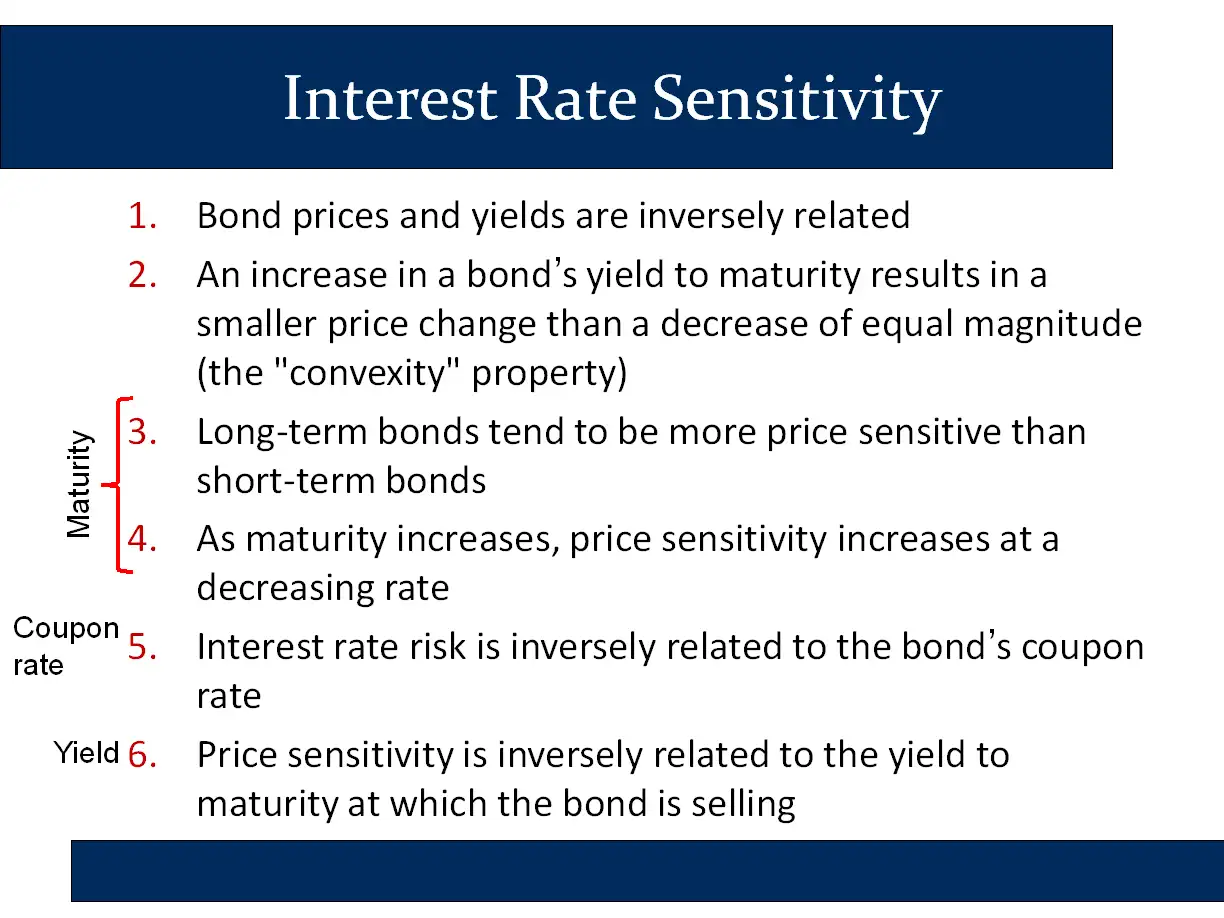

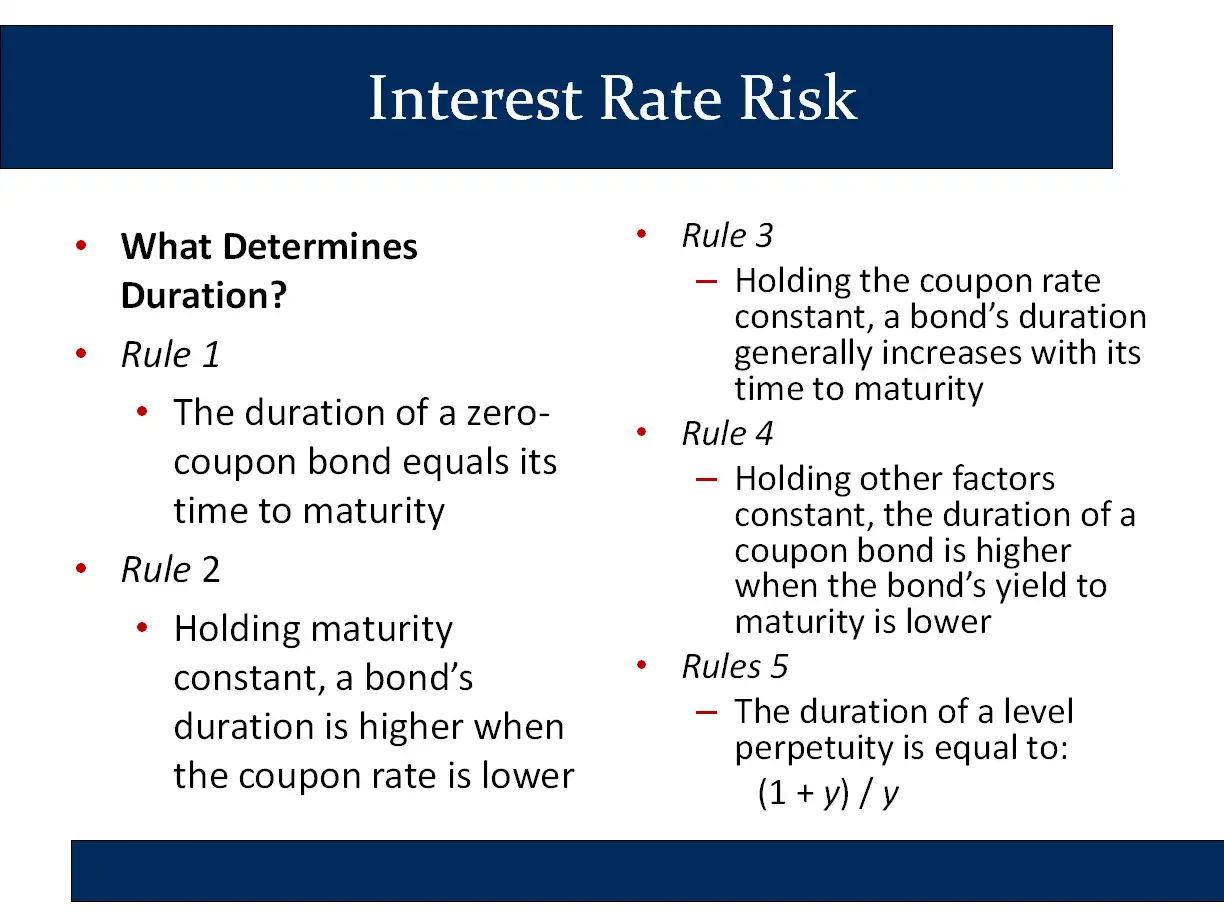

Bruce presents 6 Principles of Interest Rate Sensitivity and then, after introducing duration, presents 5 Rules that Determine Duration.

| Bonds 2: 6 Principles of Interest Rate Sensitivity | Bonds 3: 5 Rules that Determine Duration (I’ve combined two slides into one) |

|---|---|

|  |

🙋 Can you provide some background on Bond Interest Rates, Coupon Rates, and Interest Rate Risk?

See answer

Note: when we say interest rate, we mean “yield to maturity.” When the Fed raises interest rates, the YTM on bonds will generally rise. When the Fed lowers interest rates, the YTM on all bonds will generally fall.

Whenever the YTM of a bond falls, it is because it’s price has risen. This is because prices and yields are inversely related. Whenever the YTM of a bond rises, it is because its price has fallen. This is also because prices and yields are inversely related.

In 2023, “interest rates” rose dramatically. Bond prices have simultaneously fallen, driving yields to maturity up.

🙋 How can the “interest rate” on a bond change if the coupon rate of the bond is written in to the bond’s legal documents (called the indenture)?

✔ When we say that a bond’s interest rate changes, we just mean that its YTM changes. When someone talks about the interest rate of a bond changing “interest rate” means YTM.

- When interest rates rise, the price of bonds with a small duration will drop a little bit. ☹️

- When interest rates rise, the price of bonds with a medium duration will drop more. ☹☹☹

- When interest rates rise, the price of bonds with a high duration will drop a lot. ☹☹☹

We summarize this by saying: Duration determines interest rate risk.

It’s the people with long duration bonds who have to worry about their retirement when interest rates rise. (Correspondingly, it’s the portfolio managers with long duration bonds who have to worry about their income when interest rates rise.)

These two slides are connected because interest rate risk is proportional to duration.

- The higher the duration, the higher the interest rate risk.

- The lower the duration, the lower the interest rate risk.

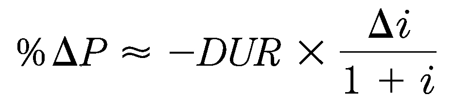

This deep connection between interest rate risk and duration is captured in the following equation:

Given this connection between interest rate risk and duration, we can understand interest rate sensitivity by understanding duration.

Bonds with high maturity have high interest rate risk and duration essentially means “maturity.”

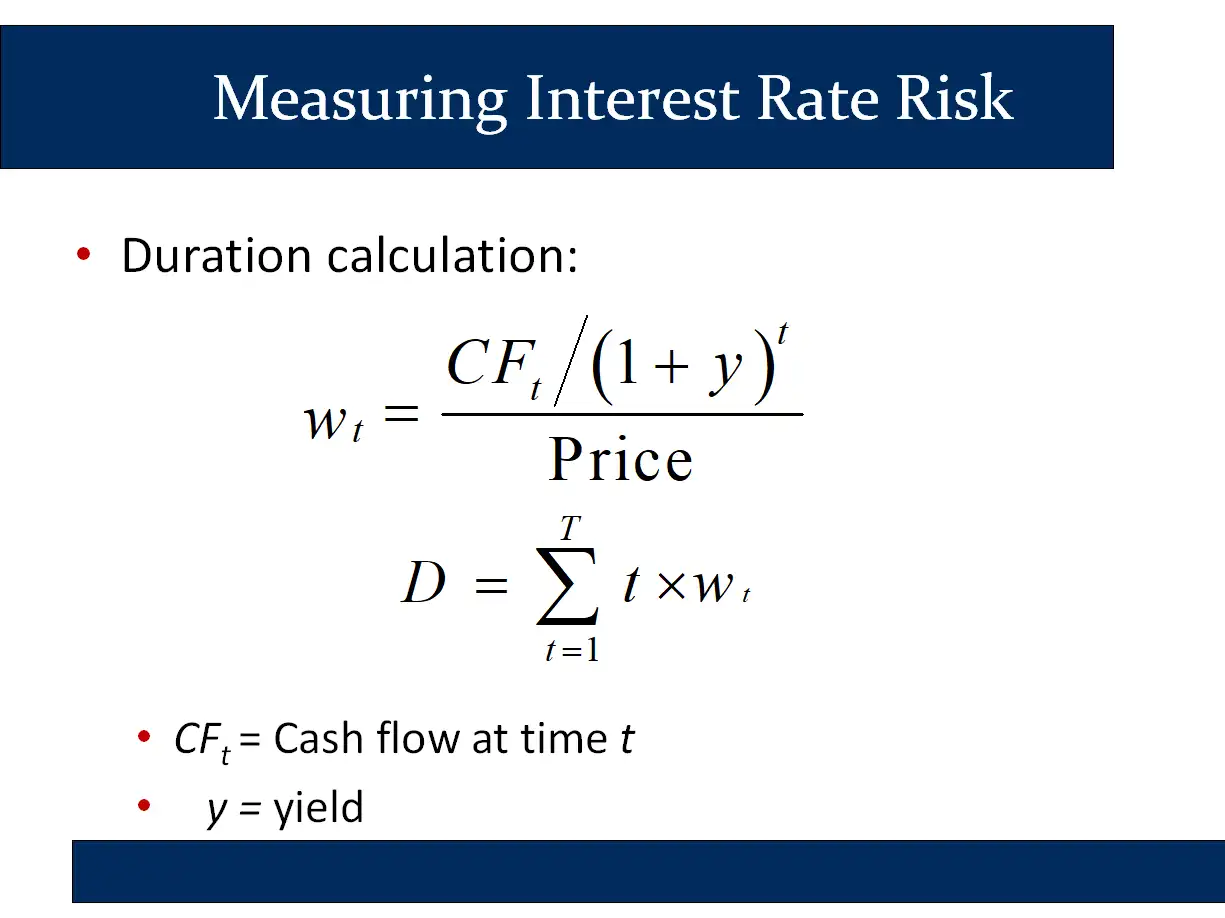

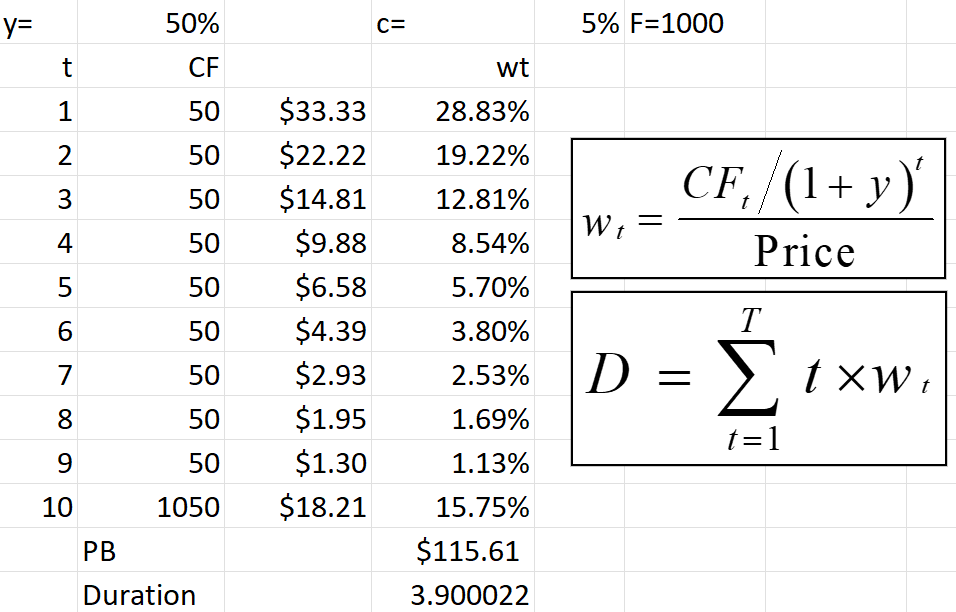

Let’s review what we know about duration. We can see it all in the two defining equations:

The second equation in the definition of duration tells us that duration is a the average time until we receive the cash flows associated with a bond. It is the “average maturity” of the cash flows in the bond.

The first equation says that this average is weighted by the present value of each cash flow we will be receiving.

- duration is a the average time until we receive the cash flows associated with a bond.

- this average is weighted by the present value of each cash flow we will be receiving.

Rules that determine duration

Duration is always a number between 0 and the maturity of the bond.

Rule 1 - The duration of a zero-coupon bond equals its time to maturity.

With a zero coupon bond, there is only one cash flow. If duration is the average time until we receive the cash flow, then the duration of a zero is just the time until maturity.

If there is only one cash flow, and you get it in 5 years, the duration must be five, because it is the average of just one number: 5.

Rule 2 - Holding maturity constant, a bond’s duration is higher when the coupon rate is lower.

Increasing the coupon rate, increases the proportion of the value of the bond that you get from the coupon payments. Since the coupon payments are received earlier than the face value payment, this decreases the average time until you receive the cash flows.

Extra bonus fact: the highest that duration can be is equal to the maturity of a bond. So, the highest duration a 10 year bond can have is 10 years. This happens when the bond is a zero coupon bond. For any bond with coupon rate higher than zero, the duration will be less than the maturity.

✏️ You are close to retirement, and you want to reduce interest rate risk. You are considering two 10 year bonds. One has a 5% coupon and the other has a 6% coupon. They are identically risky and have the same YTM.

✔ Click here to view answer

You’d choose the one with the higher coupon rate because your duration will be lower. ✅

Rule 3 - Holding the coupon rate constant, a bond’s duration generally increases with its time to maturity.

When T increases, then you will get more payments later and the final payment of the face value will be pushed even later.

Clearly, duration must be longer for a bond with a higher maturity.

Rule 4 - Holding other factors constant, the duration of a coupon bond is higher when the bond’s yield to maturity is lower.

When the yield to maturity is the discount rate used in calculating the weights of the weighted average. As the discount rate rises, you discount the later payments very heavily. You simply don’t care as much about the later payments because they are so heavily discounted. As a result, the weighted average declines.

For example, the weight on each of the times after 5 years is less than 5%, because the PV of $50 received in 6 years is very low when it is discounted at 40% per year.

Rules 5 - The duration of a level perpetuity is equal to:

Because “math.”

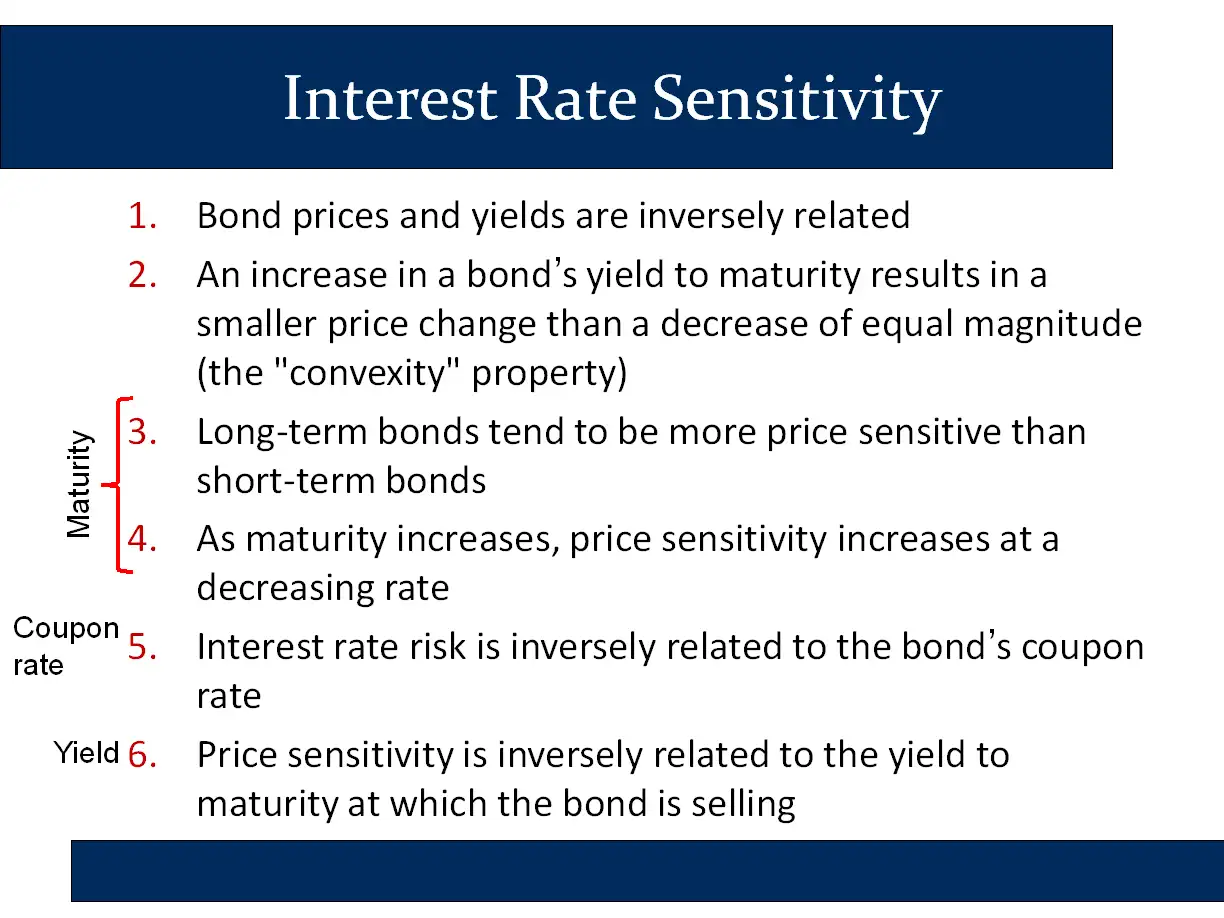

Principles of Interest Rate Sensitivity

Bruce presented 6 principles of Interest Rate Sensitivity. Can we explain them using duration?

Principle 1. Bond prices and yields are inversely related.

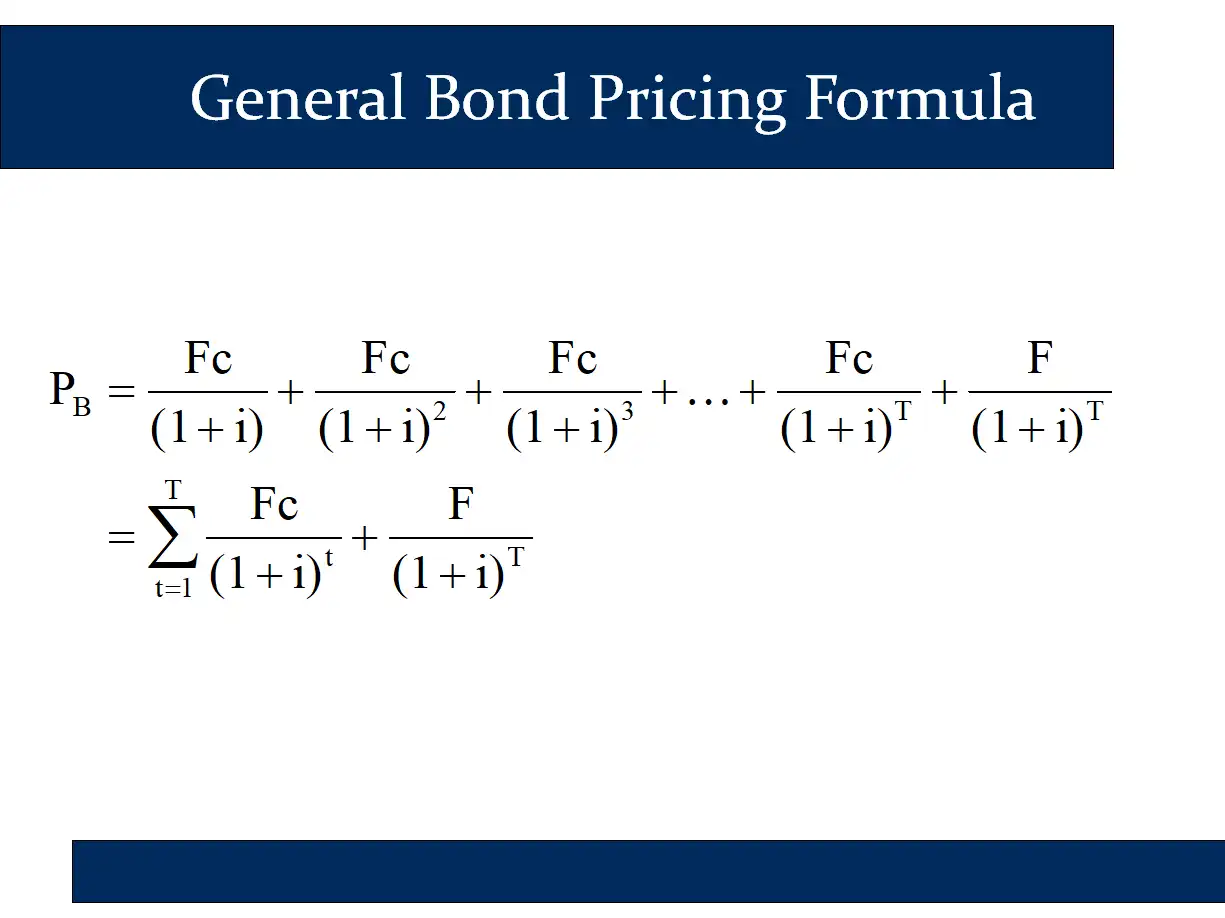

This follows from the bond pricing formula. The yields show up in the denominator of each term of the bond pricing formula as i. Therefore, when the yields rise, each term in the bond pricing formula declines and the bond price falls.

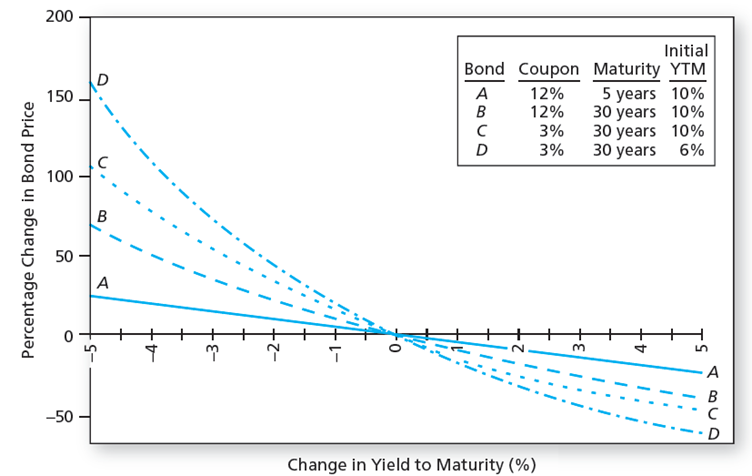

Principle 2. An increase in a bond’s yield to maturity results in a smaller price change than a decrease of equal magnitude (the “convexity” property).

This is just convexity…

Principle 3. Long-term bonds tend to be more price sensitive than short-term bonds.

Long-term bond have a higher duration, so they are more price sensitive. After all, price sensitivity is proportional to duration.

This is just duration rule 3: “Rule 3 - Holding the coupon rate constant, a bond’s duration generally increases with its time to maturity”

Principle 4. As maturity increases, price sensitivity increases at a decreasing rate.

Based on the weighting formula, if you keep on adding on more cash flows that are far distant in the future, they will all be heavily discounted, so they won’t have large weights in the weighted average. Therefore, they won’t change the duration by much.

Principle 5. Interest rate risk is inversely related to the bond’s coupon rate.

This is just duration rule 2:

“Rule 2 - Holding maturity constant, a bond’s duration is higher when the coupon rate is lower”

Principle 6. Price sensitivity is inversely related to the yield to maturity at which the bond is selling.

This is just duration 4:

“Rule 4 - Holding other factors constant, the duration of a coupon bond is higher when the bond’s yield to maturity is lower”