🔎 Semiannual Coupons

If you look very carefully at the following two slides, you can see that Bruce uses several tricks when he calculates the price or yield of a bond with semiannual coupons.

For example:

- he treats a 30-year bond as if it has “60 periods”

- he thinks of a bond with an 8% coupon as paying a 4% coupon ($40) every half year

- he doubles or halves to converge between semiannual and annual yields

This page will explain how to use these tricks to calculate the bond price and YTM for bonds with semiannual coupons.

|  |

|---|

Calculating bond price for a bond with semiannual coupons

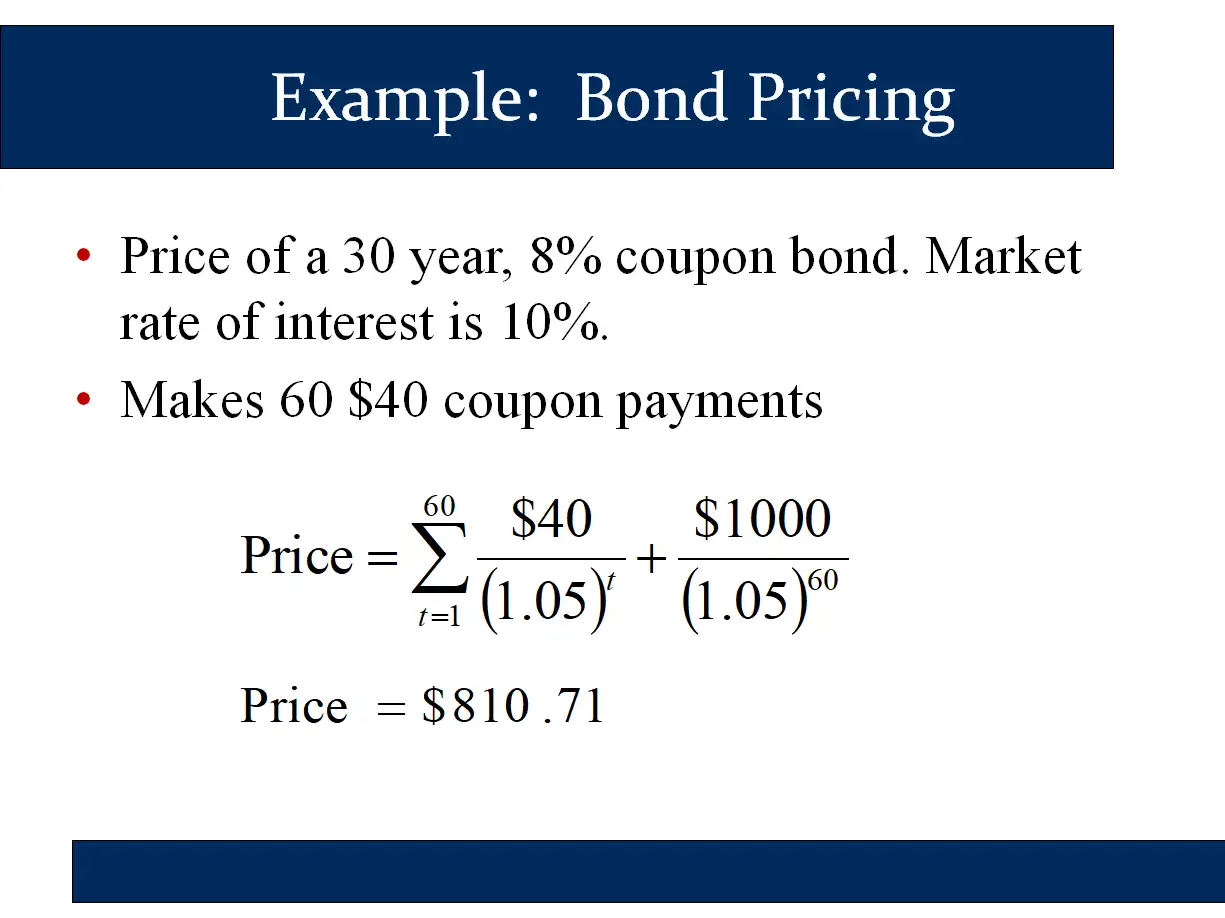

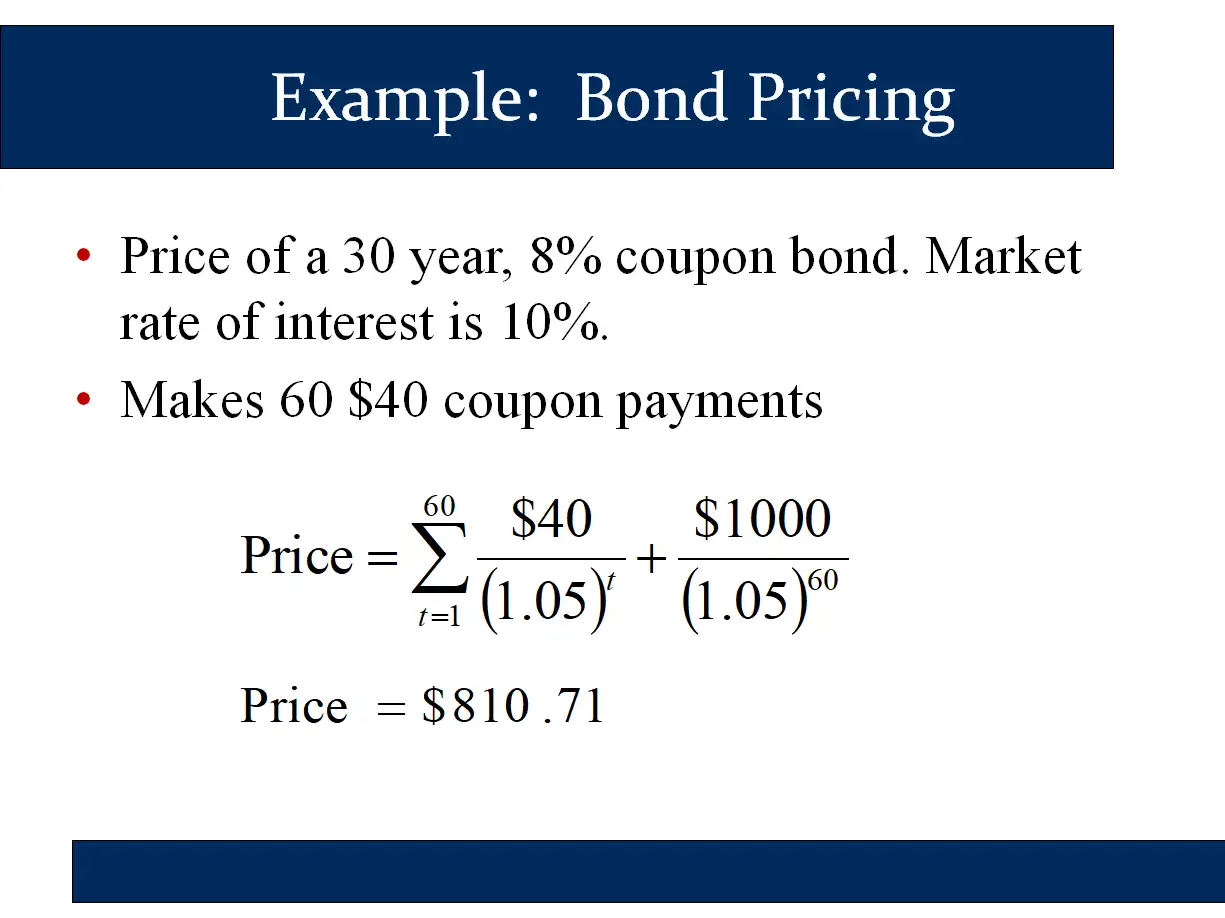

For a bond with semiannual coupons, you want to set the problem up in terms of half-year “periods” instead of twelve-month years. For example, as you can see in the example above:

- instead of 30 years, there are half-year periods

- instead of an 8% coupon every year, the owner receives a coupon ($40) every half-year period

- instead of a 10% rate of interest, you divide by 2 to get the half-year interest rate. Note that there is a convention among bond traders that annual yields are presented as twice the half-year yield. This is known as bond equivalent yield. It allows you to simply divide the annual interest rate by 2 to get the half-year discount rate.

Once you have set the question up like this, solving it is straightforward! I recommend using a spreadsheet.

Calculating yield to maturity for semiannual bonds

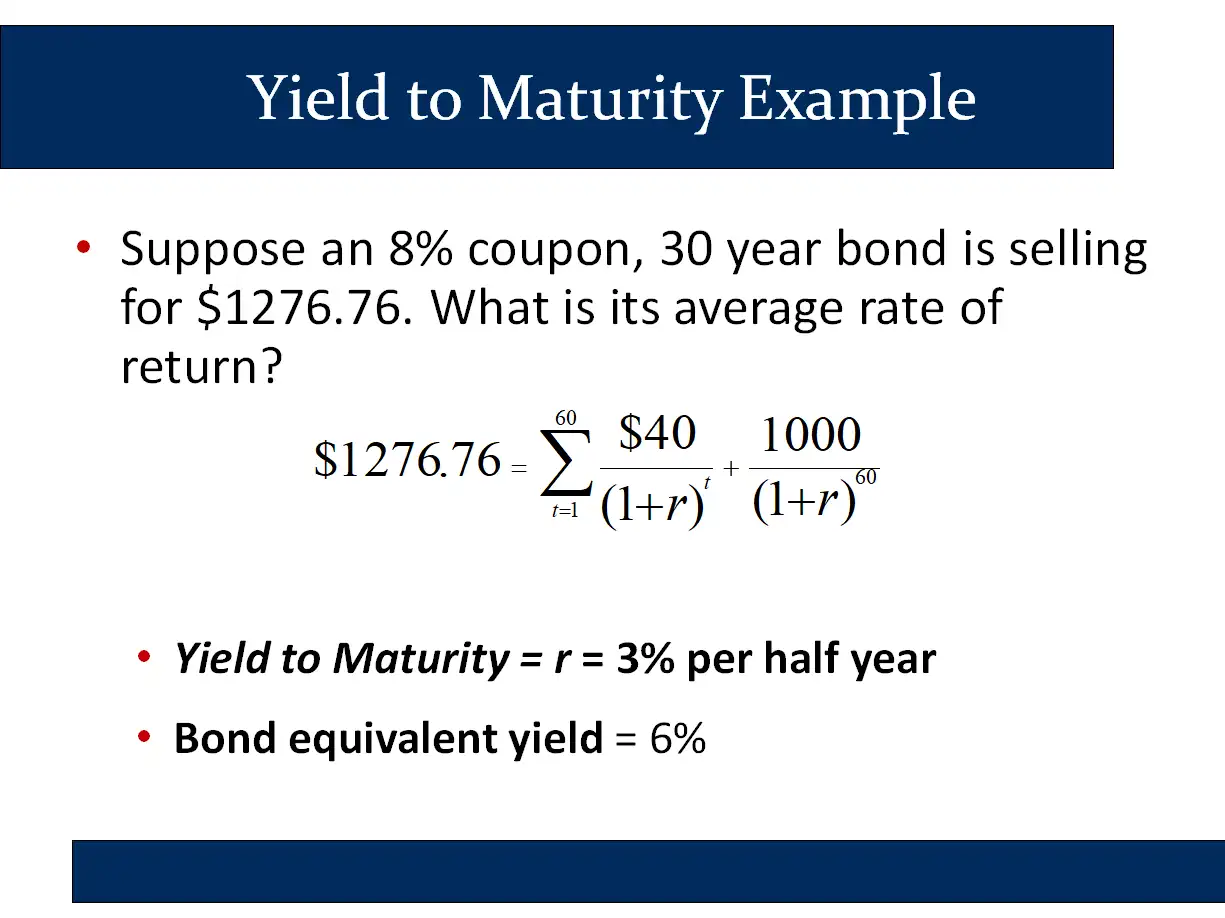

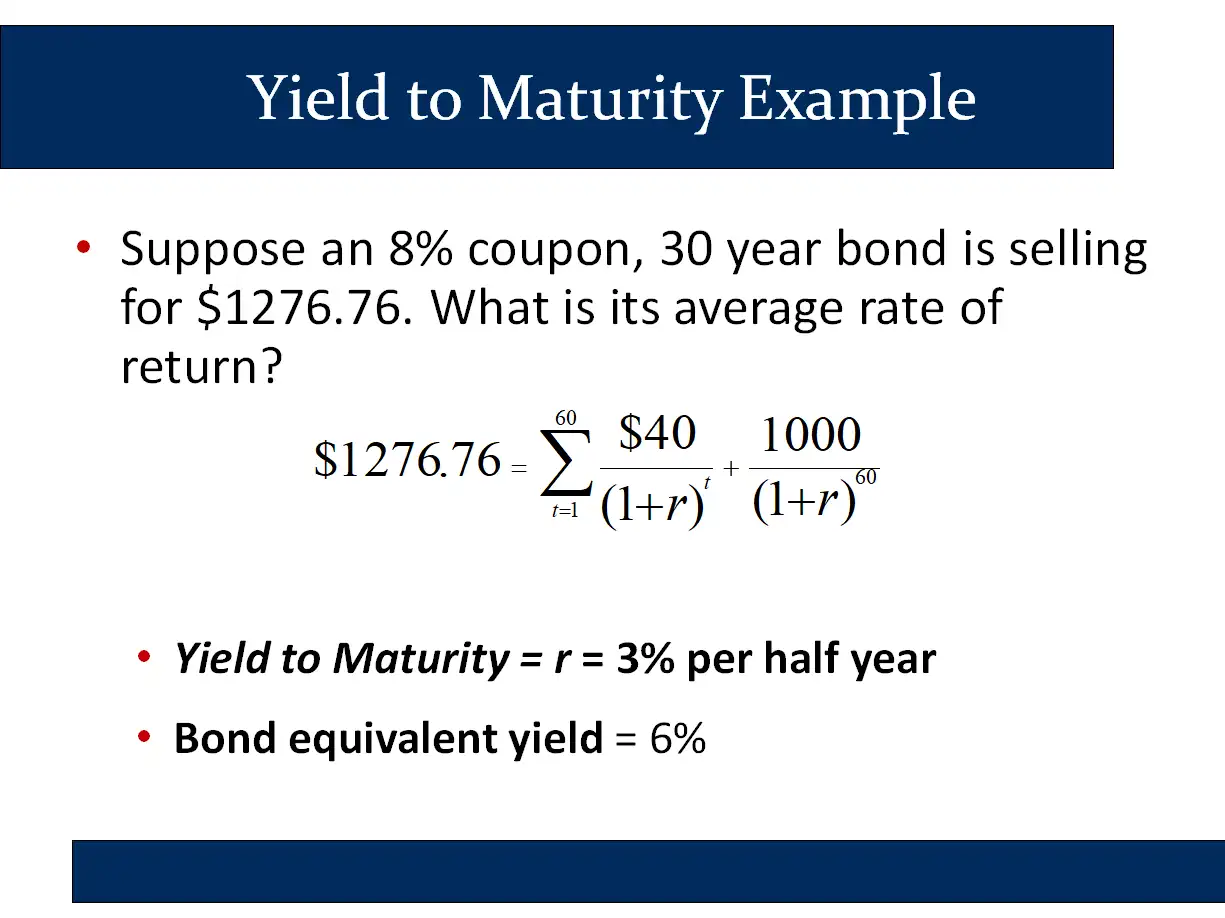

For a bond with semiannual coupons, you want to set the problem up in terms of half-year “periods” instead of twelve-month years. This is exactly what we did for the bond-pricing problem above, except we don’t need to divide the interest rate by two because we are solving for the interest rate.

As you can see in the example above:

- instead of 30 years, there are half-year periods

- instead of an 8% coupon every year, the owner receives a coupon ($40) every half-year period

Once you have calculated the half-year yield, you simply double it to calculate the bond equivalent yield.

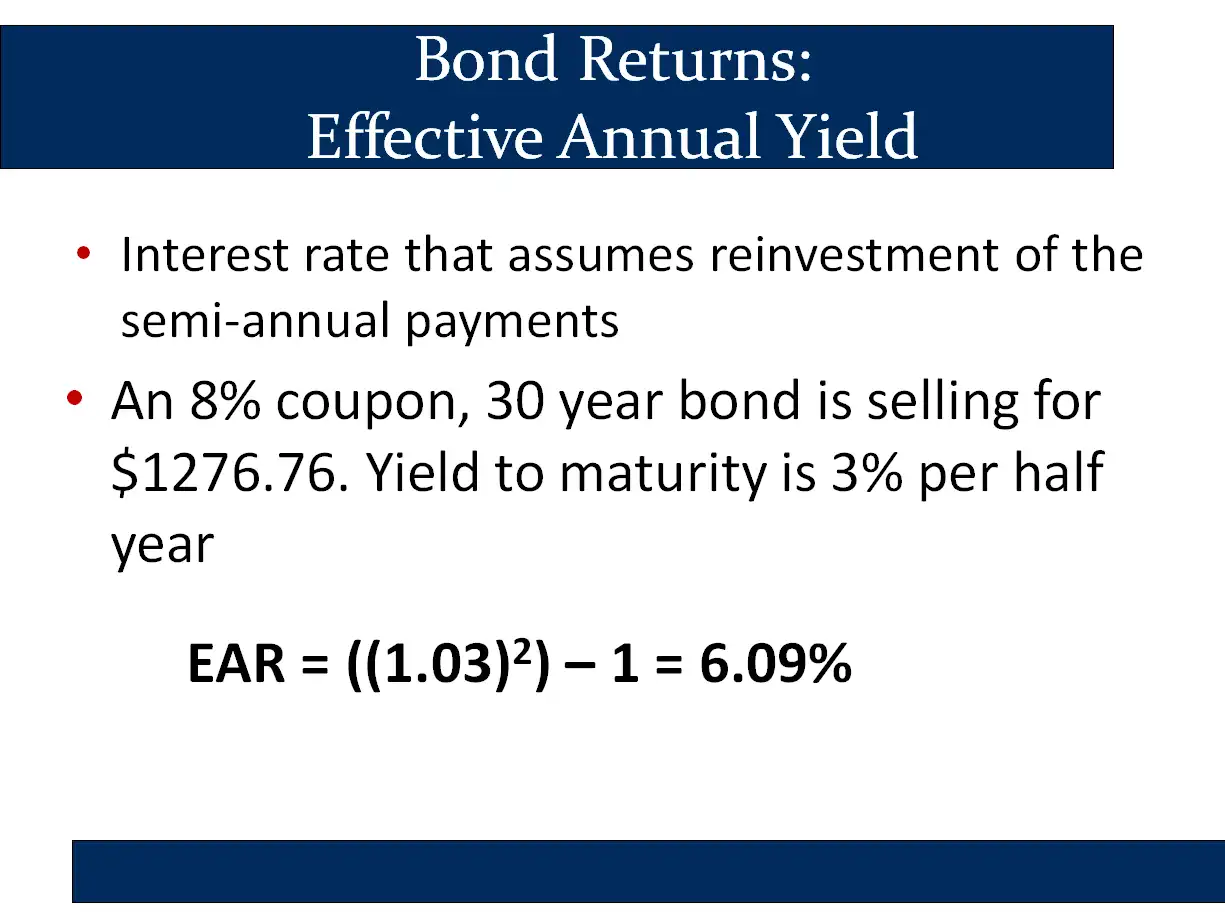

You could also calculate the Effective Annual Yield using the standard formula for effective annual rate that we covered earlier in the semester:

Wait, what’s up with all of these conversions?

Bond equivalent yields presumes simple interest, so it uses the rows that correspond to APR from the table on the following page. Most other conversions use effective annual rate, so use the EAR rows on the table. The six rows on the table tend to show up a lot in finance!

Note: for this application, , , is the half-year yield, is the bond-equivalent yield, and is the Effective Annual Yield of the bond.