🙋 Section/Student Qs for Lecture 9

Agenda for Tuesday Section, July 30 ✅

- Slide Review, concentrating on the most important and challenging slides from this week’s lecture.

- Pages about this lecture on this website. Read 🧭 Getting Oriented for how to find them on the site.

- Office Hours. Click here for notes and timestamps. Email office hour questions to robecon1452@gmail.com and I will cover them next section.

Click here to learn about timestamps and my process for answering questions.

📅 Questions covered Tuesday Section, July 30

🕣 10:44 pm

❔

I guess what I don’t understand is that you started by talking about lending to the Fed, but then you say “when you give me the money I want you to give me in return a US govt security, and then, when I give you back the money, I’ll give you back the US govt security.” So who is giving money to whom first? And why would the Fed give me (the NBFI) money in addition to a US govt security, and then take back from me money plus the US govt security? Then the last line (in the transcript above) goes back to talking about lending money to the Fed in exchange for the govt security, which makes sense to me but contradicts what came right before it.

Here’s a transcript: “hey, Fed, I want to lend you this 1 million dollars. But I need a lot of collateral. And here’s the deal Federal reserve system. You have trillions and trillions of dollars worth of bonds. So here’s what I want you to do when I lend you the money I want you to. To when when you give me the money I want you to give me in return a US. Government security. and then, when I give you back the money, I’ll give you back the Us. Government security. If you don’t give me back the money that I’ve lent to you Federal Reserve system, then I’m just going to keep the security.”

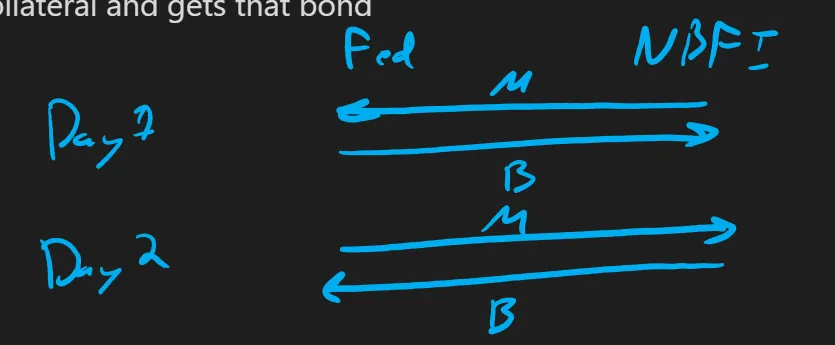

✔ In reverse repo, the Fed is a borrower. It receives money in the first day and gives the money back the following day. When the Fed has the money, it gives a bond to the NBFI as collateral. Therefore, on the first day, the FEd gives the bond to the NBFI as collateral and gets that bond back on the second day.

Here is a diagram:

Everybody gets what they started with.

It is structured as two sales. On the first day, the Fed sells the bond to the NBFI (ie it gives up the bond and gets money in return - this is what the arrows show happens on the first day). On the second day, the Fed buys the bond back from the NBFI.

Advanced note: If the price on the first day was 1.001M, then it is as if the Fed payed $.001M to borrow the cash. Thus, the difference between the sale prices on the two days is thought of as an interest rate.

🕣 9:14 pm

❔ What’s the difference between a fixed and a variable cost?

✔ Variable costs are costs that you can scale up or scale down.

If I buy a cluster of computers to run my startup, I have to pay for those computers independent of whether a recession happens. They are a fixed cost.

If, instead, I use a cloud service to rent computers from Amazon Web Services, I can cut my computer spend when a recession happens. That is a variable cost.

Union workers would be a fixed cost. Employment at will workers would be variable (layoffs).

Long term leases are a fixed cost.

🕣 9:18

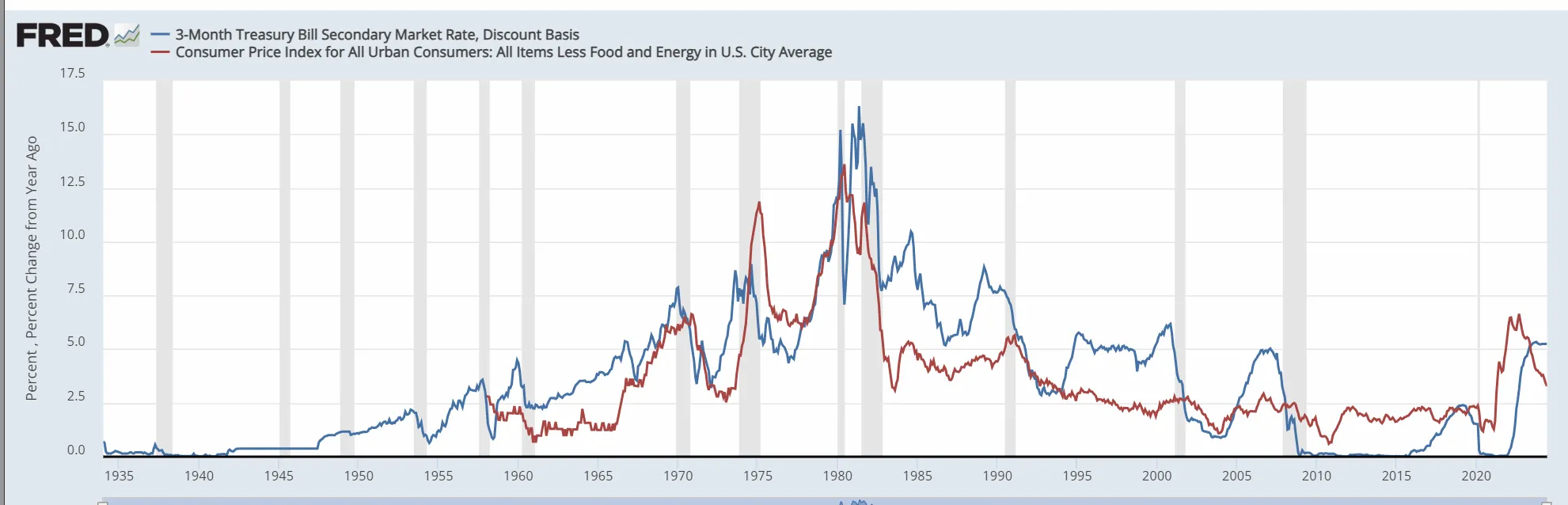

❔ How are inflation and interest rates related?

✔ In general, interest rates tend to go up when inflation goes up, and they tend to go down when inflation goes down. When inflation is 2%, then rf (risk free interest rate) might be 3%. When inflation is 10%, then rf might be 11%. Remember also that when the risk free rates go up or down, other interest rates for the same time period will also go up or down. This is because

(nominal) interest rate = real interest rate + expected inflation

Therefore, when the inflation rate is higher, the nominal interest rate will be higher, too.

🕣

❔

Can you review the yield curve again?

✔ Covered during video

🕣 9:18 ❔ Can you help me interpret q14?

✔

🕣

❔ Can you help me interpret q5?

✔ Covered before 10:55 in video. Think of the options as each havign a letter, A-E

🕣

❔ can you review Ample reserves regime?

✔

🕣

❔ For the late paper submission - it is due by Aug 6th correct?

✔ Due by Aug 6 at 11:59pm, ET

🕣

❔ Can you review what happens when a bond is at par or above par and how it affects duration?

✔ The comparison between face value/par and bond price has no direct affect on duration. However, when a bond sells at par, you know that the yield equals the coupon rate. Sometimes knowing this can be helpful when solving duration questions, because sometimes in a duration question, you need to know the yield. If the bond is sold at par and youknow the coupon rate, you can use this to find the yield.

🕣

❔ Also is there a quick way to figure out duration or do you always have to do the spreadsheet?

✔ Look up the page in this site, “quick duration calculations”

🕣

❔ 1. Asset pricing bubbles occur when it fall back to the fundamental value (or below) quite rapidly.

Do inflation and deflation count as asset pricing bubbles?

✔ No.

🕣 7:52

❔ 2. Optimism-driven bubble: Resulting wealth transfers are not good for the economy.

What does this mean?

✔ It just means that random transfers of assets from some investors to other investors are inefficient ways distributing resources. Whether you win or lose in a bubble is fairly random, depending on whether you bought and sold at the right time.

🕣

❔ 3. Credit-driven bubble: created when easy credit terms spill over into asset prices. Very dangerous when the bubble ends - the downward spiral can be more damaging than the asset bubble.

What does “easy credit terms spill over into asset prices“ mean?

What’s the downward spiral?

✔ Easy credit terms means that it is very easy to borrow money. In situations like this, people can buy securities using borrowed money this can cause prices of those securities to rise. In other words, the easy credit terms can spill over into asset prices, causing those prices to rise.

🕣 11:00 pm ❔ 4. Why shouldn’t the Fed respond to bubbles? Rate changes “may do nothing“ [interest rates may have no effect on stock prices]. “Rates are a blunt instrument“ [changing interest rates will affect many other aspects of the economy. It’s better to just leave the interest rates at their natural levels] - affect many asset prices in the economy. Policy reactions after the bubble bursts may keep damage “at a reasonable level“ [If we follow the Greenspan doctrine and let the bubble burst, then we can clean up afterward and there will be some damage, but it will be tolerably bad, like the damage after the doct com bubble was tolerably bad. In contrast, the damage after the great financial crisis wasn’t tolerable in some views]. Could you elaborate on the parts in quotations?

✔ Covered in video and in square brackets

🕣

❔ 5. Could you talk more about exchange risk?

✔ Covered in video.

🕣

❔ 6. When were the past financial crisis?

✔ Great financial crisis and the great depression.

🕣

❔ 7. Difference betwn the 2 graphs: euros/dollar and nominal advanced foreign economies

✔ Euros/dollar tells us how many dollars 1 euro is worth. The second is the general strength of the dollar.

🕣

❔ I don’t think I can distinguish supply and demand shocks

✔ If it affects how much purchasers are willing to buy (at a given price), it is a demand shock. If it affects how much companies are interested in selling (at a given price), its a supply shock.

s1452 Help Links: 👨💻

- General Info on sections and using this website.

- Email office hour questions to robecon1452@gmail.com. PS1Q2=“Question 2 of Problem Set 1”

- Slides with handwriting from section and other useful files