🔎 Duration

The following formula is very helpful for quantifying interest rate risk.

Starting fact: for a Zero Coupon Bond, Duration = “time to maturity.”

✏ Suppose you have a 10 year zero coupon bond with a yield of 5%. What percentage of the value of the bond will you lose if the yield rises 1% to 6%? How about if it dropped to 4%?

✔We can use the formula.

Because it is a zero, DUR = 10 years

(rise of 1%)

Roughly speaking, yields went up 1% and you lost 9.52% of the value.

For the second question

The minus sign is in the formula to ensure that when yields go up, prices go down (like in the first example) and that when yields go down, prices go up (second example).

✏ Suppose you have a 5 year zero coupon bond with a yield of 5%. What percentage of the value of the bond will you lose if the yield rises 1% to 6%? How about if it dropped to 4% How about if it was a 2 year zero coupon bond?

✔

5 year:

2 year:

If you think interest rates will rise a lot (more than the market expects), you shift money from intermediate-term bonds to short term bonds. Here’s why. When yields go up, prices go down, so both funds will lose money. However, the intermediate term bonds have a higher duration, so they will lose more value, like the 10 year zero above, rather than the 5 year zero.

We have this excellent tool for quantifying interest rate risk, but right now it only works with a zero coupon bond…

How do we generalize it, so that we can figure out the interest rate risk of ANY bond or even any portfolio of bonds? DURATION.

A graphical display may help understand how Duration is a generalization of what we have been doing.

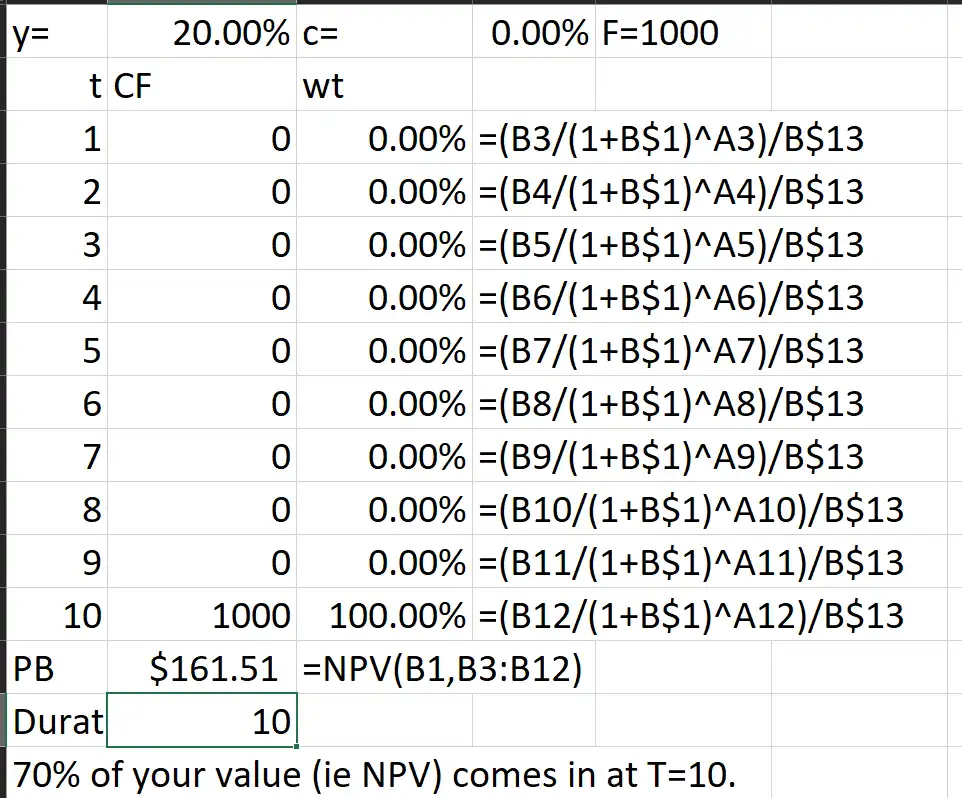

With a zero coupon bond, all of the cash flows happen on the maturity date.

Duration is fundamentally about “when you get the money.” For a zero, you get it all at once, at time T.

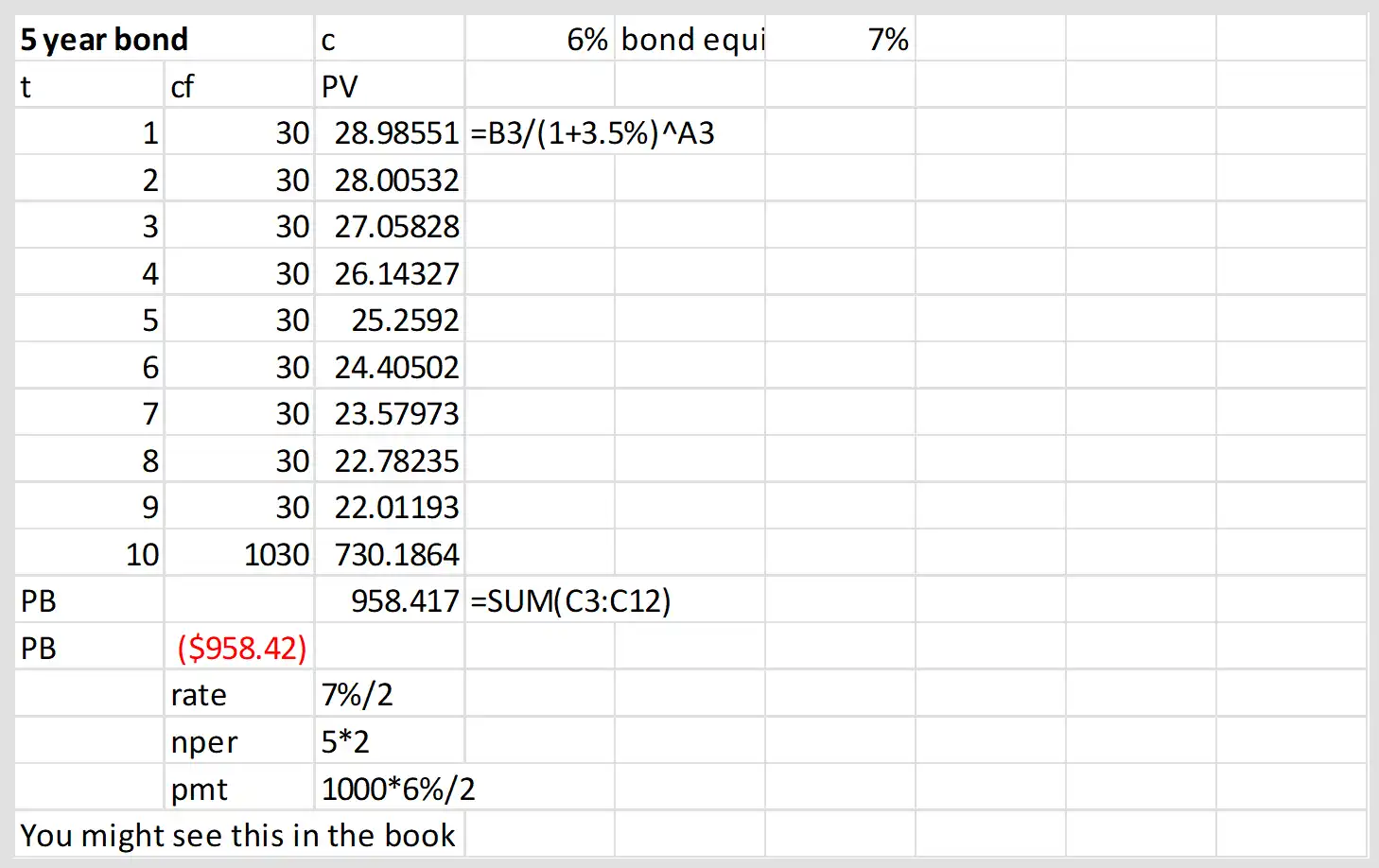

Not so with a typical coupon bond. With a coupon bond, you get money at time 1, 2, 3, 4, 5, …. T:

If duration is fundamentally about “when you get the money,” and you are getting the money at different times, which of those times should be the duration.

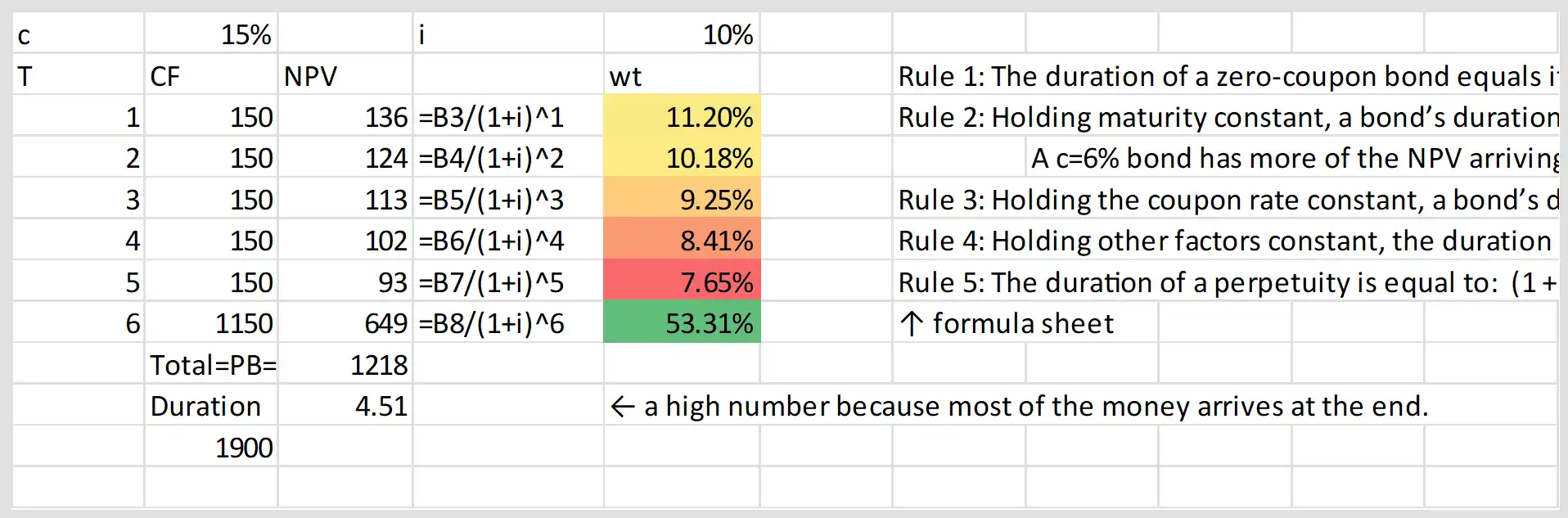

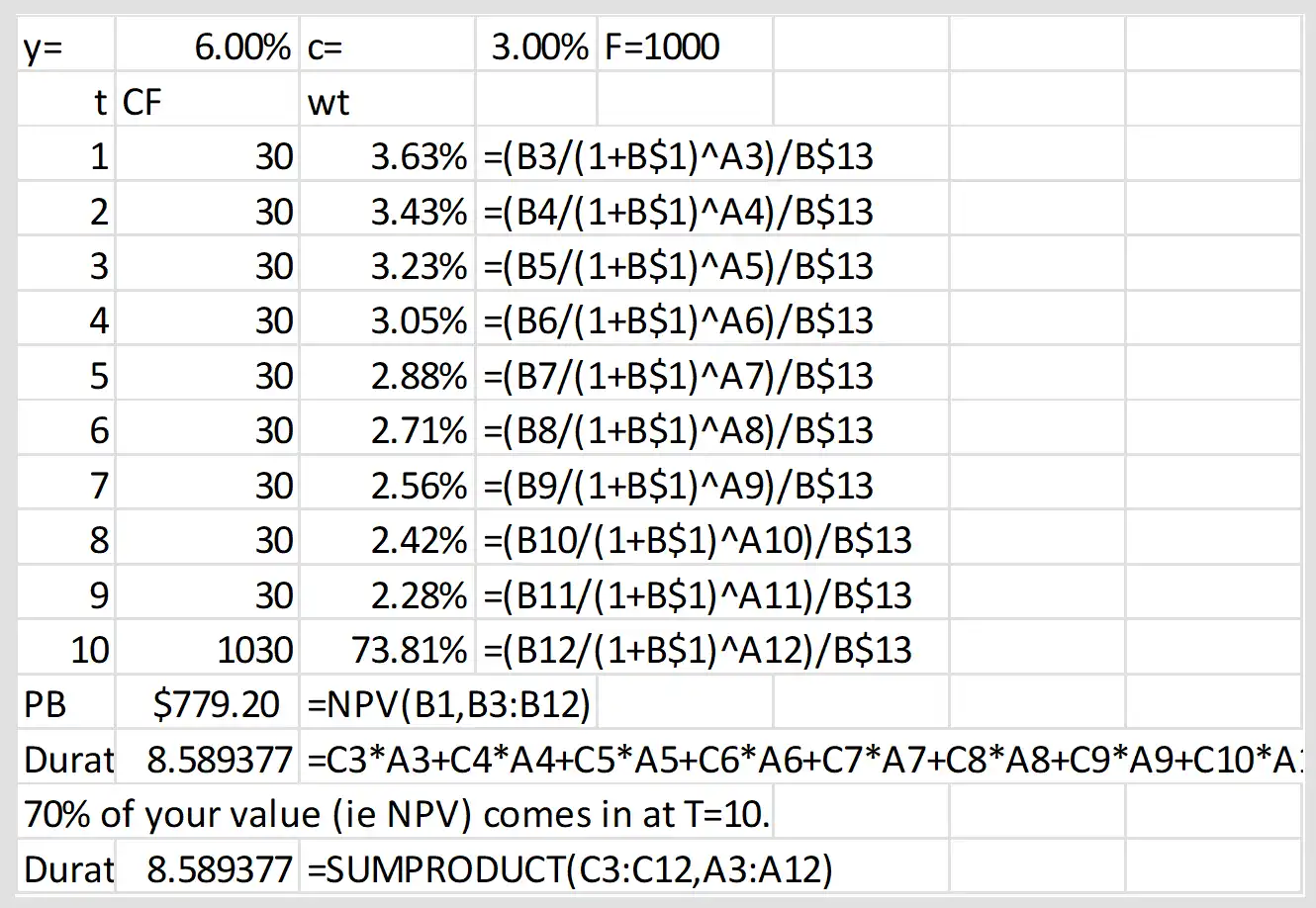

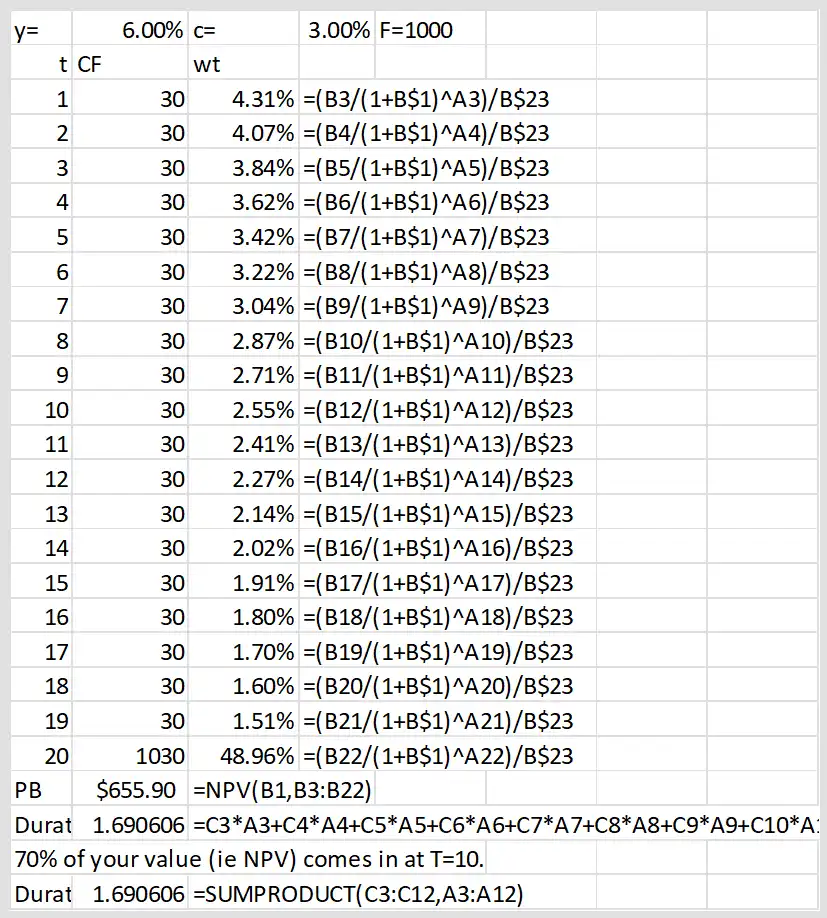

Rather than choosing one of those times, we just take the weighted average of all of the times.

A weighted average always looks like this:

1,2,3,4, etc are the times “when you get the money,” and we are taking a weighted average of these different times, using weights w1, w2, w3, …., wT.

The only question that remains is, “what should we use for the weights?” However, because this is finance, there really is only one option: the present value of the cash flows. In a weighted average, the weights must sum up to 1, so we’ll do a little trick and divide by the PB. This will ensure that the weights add up to 1.

We can see from the following that the duration of a zero coupon bond is always equal to the time to maturity of that bond (discussion below).

The duration is always the weighted average of “when you get the money.” With a Zero, you get all of the money when the bond expires, so the weighted average puts all the weight on T=10, because that’s when you get all the money!

✏ If I have a 30 year bond, what is the highest duration it can possibly have?

✔The duration is always the weighted average of “when you get the money,” and you get the last money in 30 years, so 30 will be the highest number in the weighted average. If you take a weighted average of several numbers, and the highest number is 30, then the weighted average can’t be higher than 30.

⇨ The duration will always be less than or equal to the maturity, and it will only equal the maturity when the bond doesn’t have a coupon. (ie a Zero.)