🙋 Section/Student Qs for Lecture 3

Agenda for Tuesday Section, July 2 ✅

- Slide Review, concentrating on the most important and challenging slides from this week’s lecture.

- Pages about this lecture on this website. Read 🧭 Getting Oriented for how to find them on the site.

- Office Hours. Click here for notes and timestamps. Email office hour questions to robecon1452@gmail.com and I will cover them next section.

Click here to learn about timestamps and my process for answering questions.

📅 Questions covered Tuesday, July 2

How to calculate sigma_p

🕣

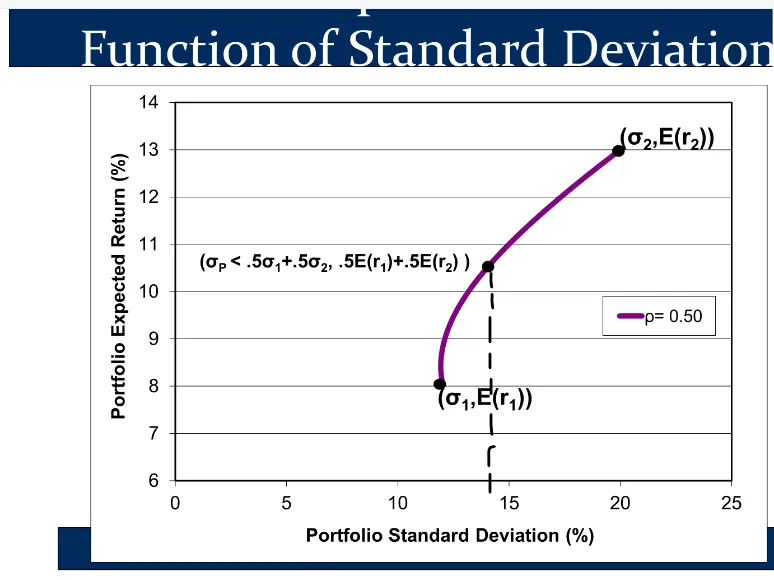

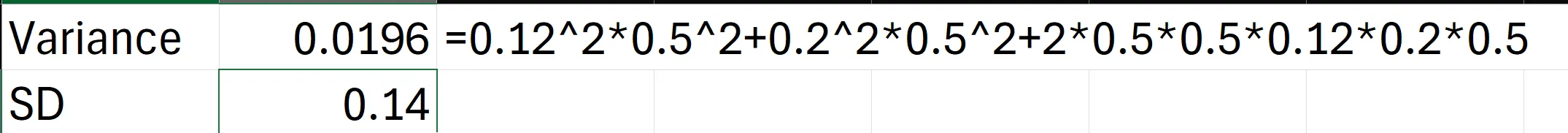

❔ Managing the risky portfolio: In the graph of Portfolio Expected Return vs. Portfolio Standard Deviation, there’s a point on the line that represents 50% invested in asset1 and 50% invested in asset2. I understand how we got the Expected Return, but I’m not positive on how to get the sigma_p.

My equation for sigma_p at that specific point = .122(.52) + .22(.52) + 2(.5)(.5)(.12)(.2)(.5) which gives me 0.0196. In other words, the Standard Deviation is 1.96%. If that’s the case, why does the graph say the Standard Deviation is about 14%?

✔ It does that because he isn’t sure at that point that he has given you the official formula.

You’ve done a great job of calculating variance there, but you need to take the square root to calculate the standard deviation .

Excel Solver

🕣 8:10ish

❔ What is the name of the extension from Excel Solver and Google Solver that can help me find the optimal risky portfolio?

✔ https://support.microsoft.com/en-us/office/load-the-solver-add-in-in-excel-612926fc-d53b-46b4-872c-e24772f078ca I presume this works: https://coefficient.io/google-sheets-tutorials/how-to-use-solver-in-google-sheets

🕣 8:14

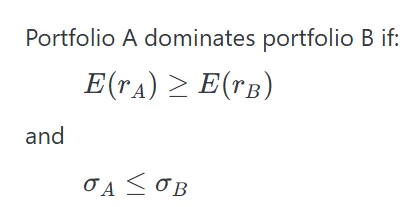

❔ If E[r_A] = E[r_B] and sigma_A = sigma_B, can we choose either portfolios?

✔ Absolutely. In mean-variance analysis (what we are doing), every portfolio is assessed based on it’s Expected REturn (mean return) and its variance (or sd). If they are equal, then the portfolios are equivalent.

🕣 9:20ish

❔ Does beta follow the same rules as sigma? How is it the same or different?

✔ Beta is like “sigma-plus-correlation.” It measures total risk, like sigma does, but it also factors in correlation with the market portfolio. Doing so allows it to measure the nondiversifiable risk that the security adds to your portfolio. It measures how miserable you are having that security in your portfolio.

Intuitively, imagine two stocks that have the same standard deviation: Altria and Hermes. However, when the stock market craters, people still buy food and cigarettes, so Altria does fine. In contrast when the stock market craters, people don’t buy as many luxury goods, so Hermes craters, too.

Which would have a higher beta? They have the same SD, but Hermes craters when the stock market craters, so it has a higher correlation with the market portfolio and therefore has a higher beta.

Which would you rather have in your portfolio. ALTRIA! Hermes will be worth less when you need it the most (ie when the rest of your portfolio is worth less). In contrast, Altria will hold up its value when you need it the most.

s1452 Help Links: 👨💻

- General Info on sections and using this website.

- Email office hour questions to robecon1452@gmail.com. PS1Q2=“Question 2 of Problem Set 1”

- Slides with handwriting from section and other useful files