✏️ Options Self-Test

You may wonder how well you need to understand from the readings. There is a very simple answer to this question: you will want to know the material well enough to be able to follow along with the next lecture that Bruce delivers.

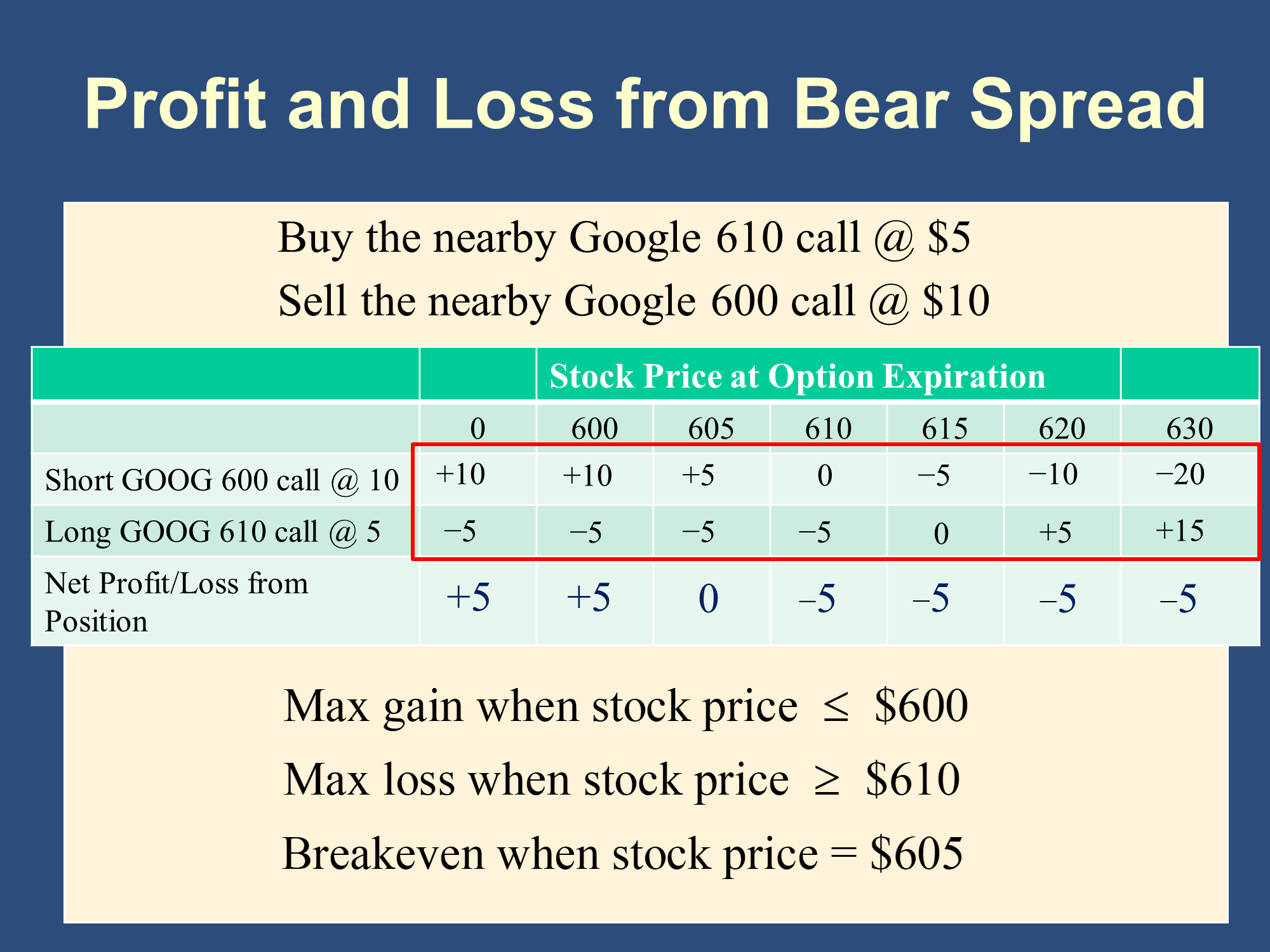

In the following lecture, Bruce will want you to understand how to fill in the numbers in the red box of the following slide. It is very important that you are able to do this. The good news is that if you can, you are doing great:

Note: This week I will not be discussing anything on the slide below the red square. That material relates to the material that Bruce will introduce in the next lecture, and he introduces material first. My goal is only to encourage you to practice per-share P/L calculations for individual option contracts until you can do them quickly and confidently.

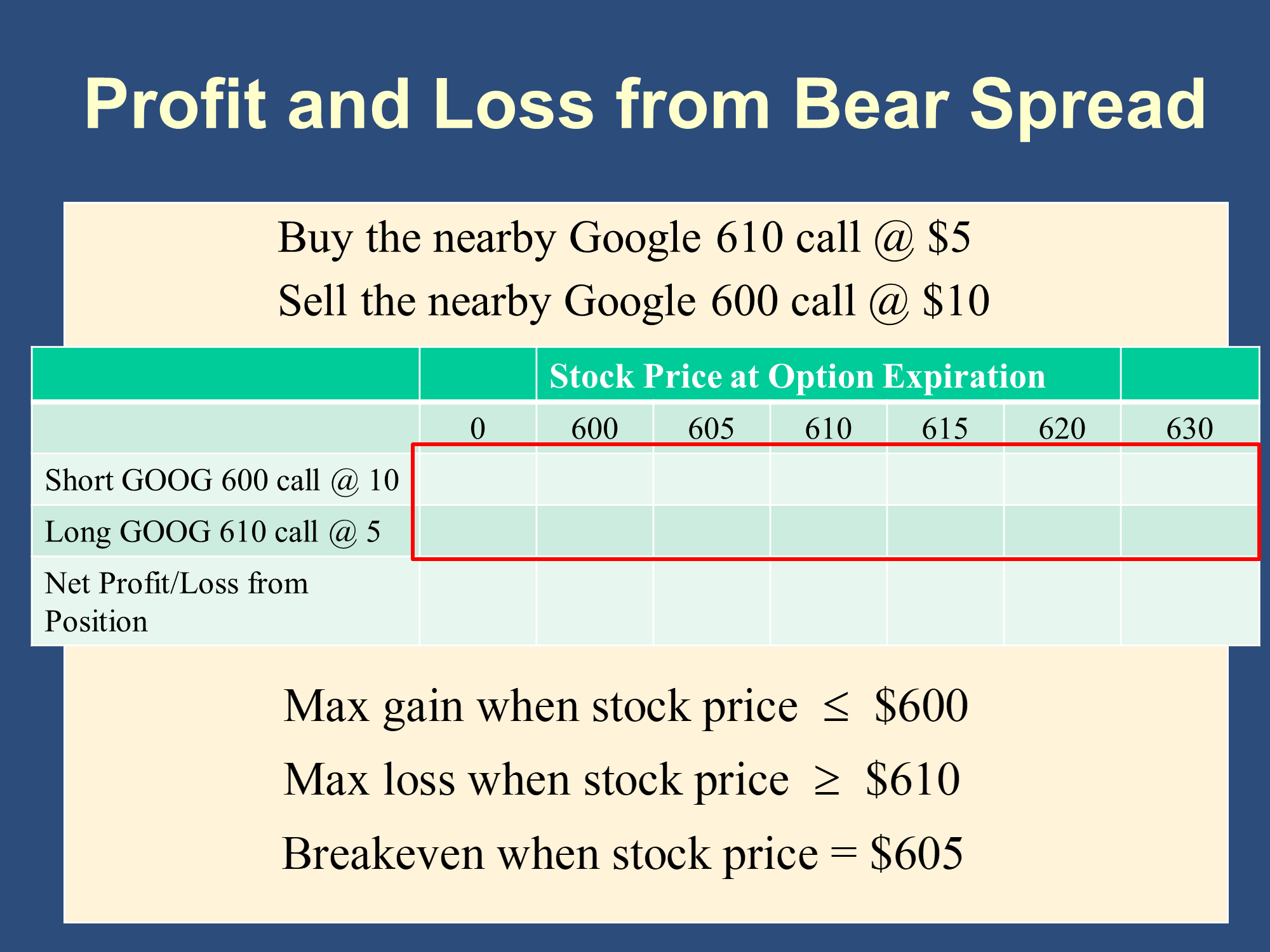

Note: This week I will not be discussing anything on the slide below the red square. That material relates to the material that Bruce will introduce in the next lecture, and he introduces material first. My goal is only to encourage you to practice per-share P/L calculations for individual option contracts until you can do them quickly and confidently.

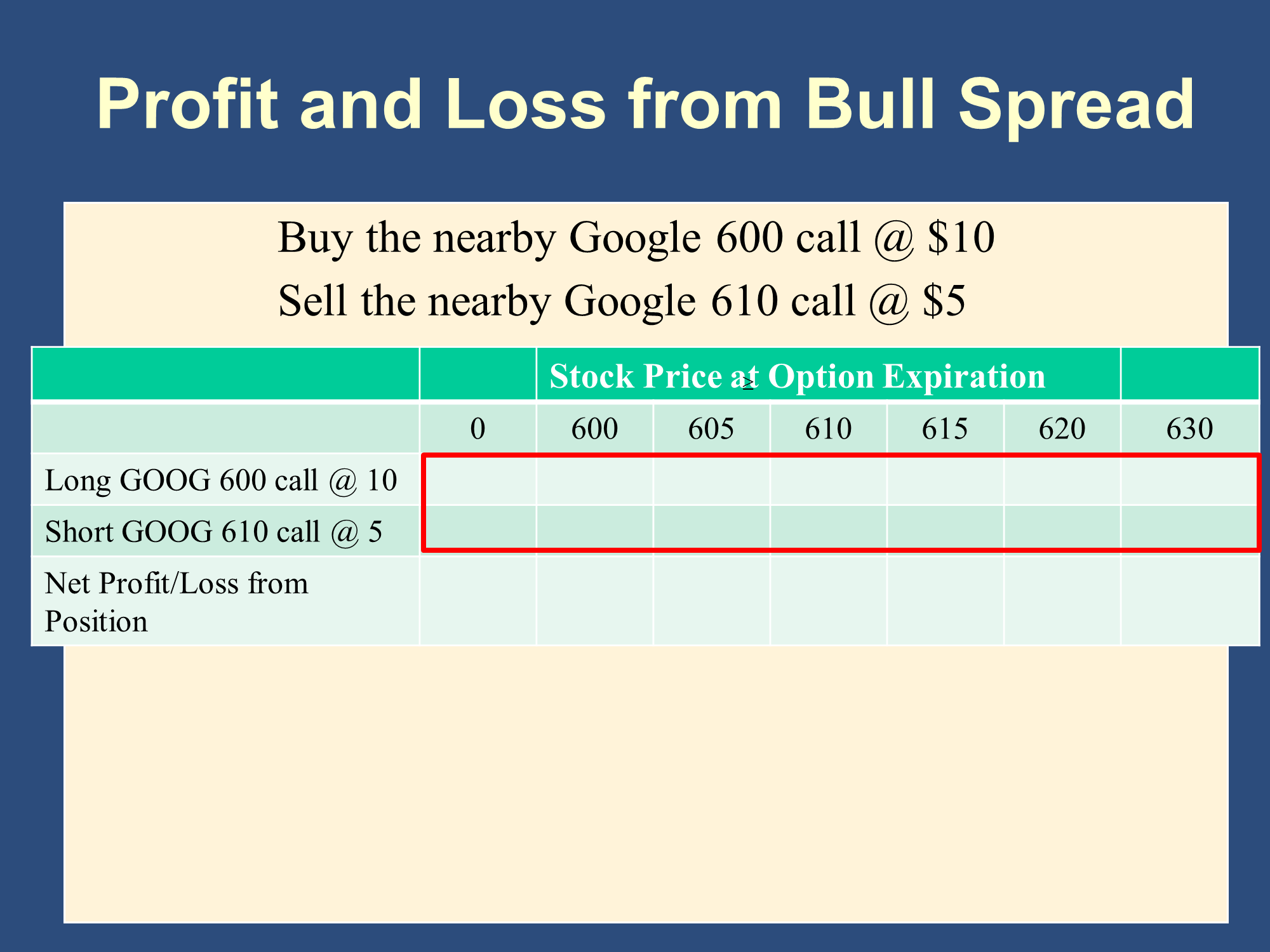

In the upper-left box, you’ll need to calculate the profit or loss from buying a GOOG call with a strike price of 600 that you pay a premium of 0.

The answer is that because you wouldn’t exercise the option, the option would expire worthless and you would have lost the premium for the option, which is 10 per share.

The next number to the right is your P/L if the stock price was 10 again? Can you verify the other P/L’s in this row?

Your goal is to be able to figure this out. I am here to help.

You’ll also want to be able to fill in the following row. For it, rather than buying a call, you are selling a call. In particular, the call you are selling has a strike price of 5.

I timed him and the last time he covered this, he went through both rows in six minutes and 31 seconds (he also filled in the six boxes below the red rectangle, but you aren’t responsible for those and they are easier).

|

| Stock price at option expiration (S) → | S=0 | S=600 | S=605 | S=610 | S=615 | S=620 | S=630 |

|---|---|---|---|---|---|---|---|

| Short GOOG 600 call @ 10 | |||||||

| Long GOOG 610 call @ 5 |

Note that rather than filling out an entire row at a time, he did the columns of the table one-by-one (try it this way— it’s harder).

Scroll down for answers.

Here’s another example.

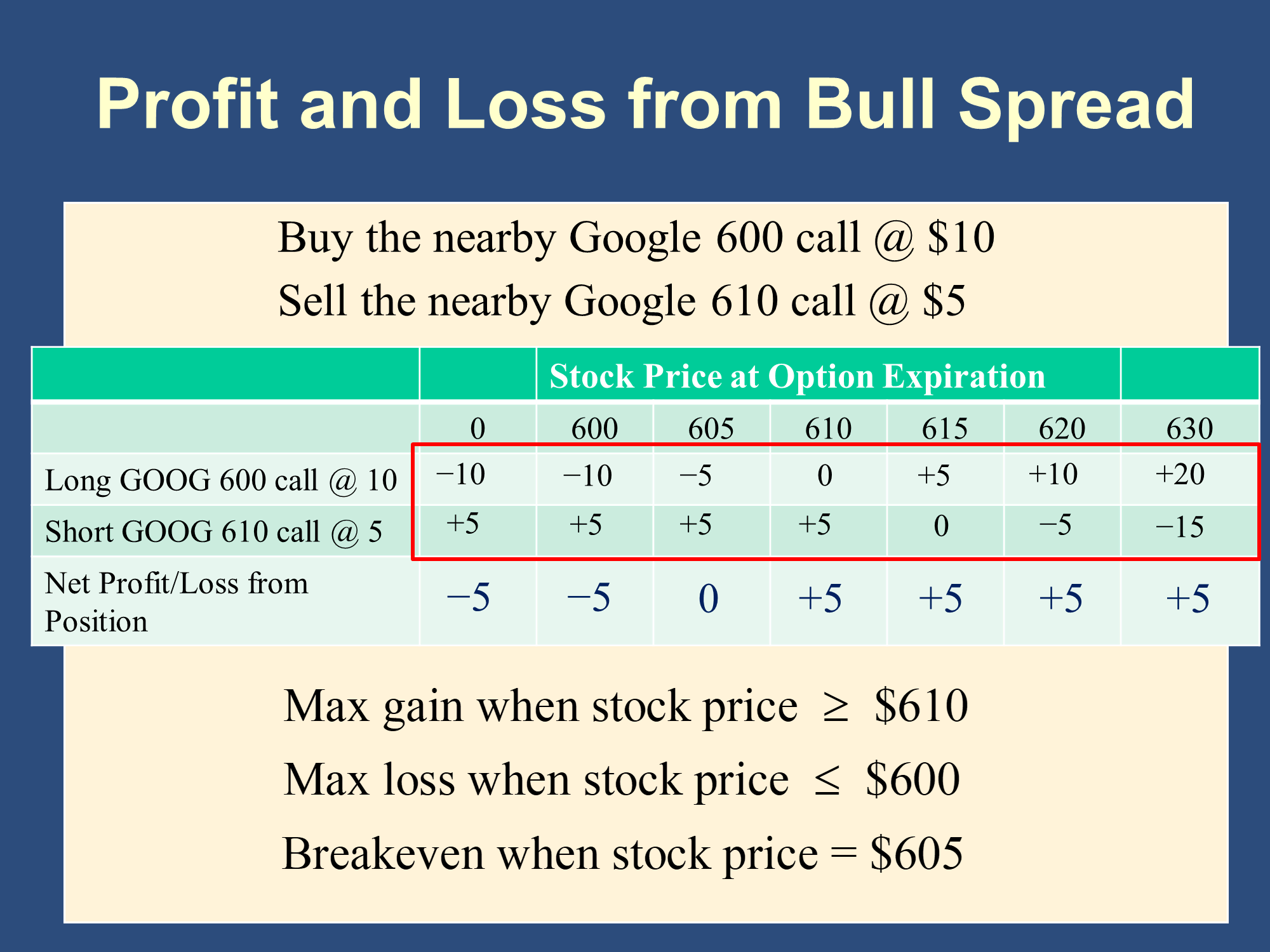

Answers from the first slide:

Answers from the second slide: