🙋 Section/Student Qs for Lecture 10 and Exam 2 Review

We will cover both lecture 10 and student questions related to Exam 2 during this section. To help you find relevant content, I will make this page appear in the sidebar under both lectures.

Agenda for Saturday Section, Aug 3 ✅

- Office Hours. Click here for notes and timestamps. Email office hour questions to robecon1452@gmail.com and I will cover them next section.

- Solutions for Problem Set 5, Questions 6, 7, 8, 9, 13, and 14.

- STart at 4:16

- Slide Review, concentrating on the most important and challenging slides from this week’s lecture.

- Pages about this lecture on this website. Read 🧭 Getting Oriented for how to find them on the site.

Click here to learn about timestamps and my process for answering questions.

📅 Questions covered Saturday, Aug 3

🕣 3:17 pm Saturday

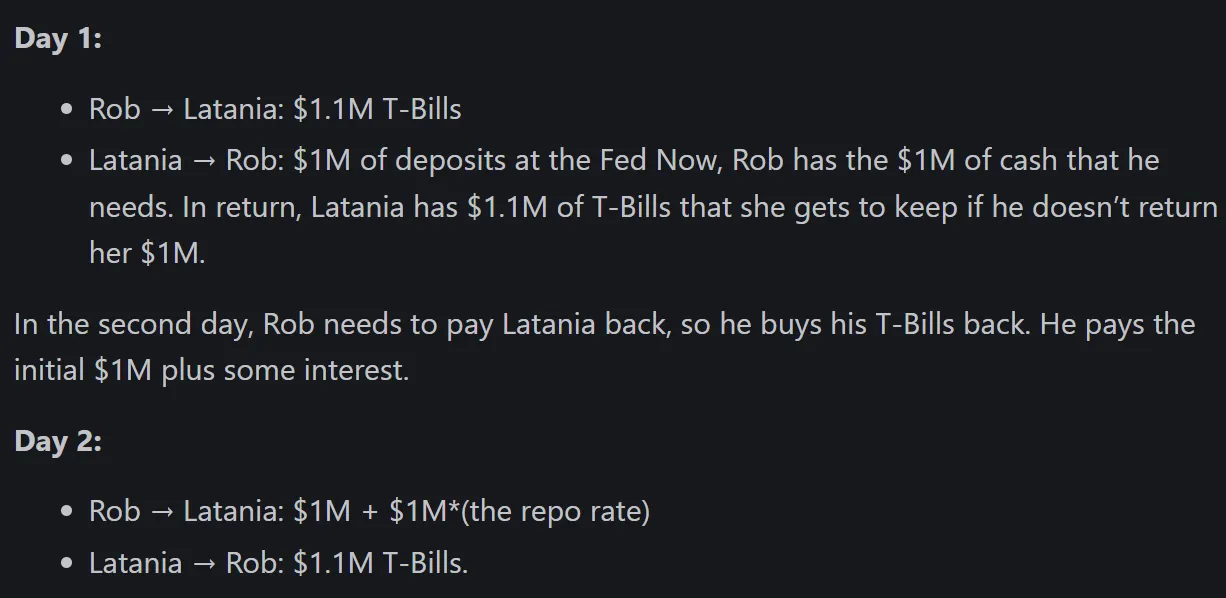

❔ Why do we assume that the value of the govt security - given to the NBFI as collateral - goes up? What if it goes down by the time the Fed has to buy it back? Or is it the case that the change in value does not matter? Is it the case that the ON RRP rate is the interest that the Fed pays the NBFI for borrowing some money, and the govt security is just collateral? And that whether the value of the collateral goes up or down is irrelevant, and just bad luck for the NBFI if it goes down by the time it gets it back? I would appreciate if you can go into the details on this.

✔ WE covered this in the page on repo in lecture 8. See the recording.

🕣 Saturday

❔ Can you review the duration formula again?

Please add it to your formula sheet!

✔ Done in section. Covered in the Excel Functions page.

🕣 Saturday

❔ Last night section was really useful to re adjust my attention on the useful examinable things rather than go deep into some particular concept ( like I did last time). Is the recording going to be uploaded ?

the only question Im not sure off is the one that he introduces the bid and ask price at PS4.

✔ Recording is uploaded to the Zoom section of Canvas. I don’t have access to the Class Recordings page, but I’ll see if I can get them to.

If you are buying a security, look at the ask column. If you are selling a security, look at the bid column.

🕣 4:06 pm Saturday

❔ For Bond pricing, we use PV formula. In that, the type is binary. We always use 0. Is there any case where we use 1.

✔ Not that I can think of. I don’t think he’s interested in “strange” examples. He wants to make sure that you’ve learned all of the key skills well enough to do well on a closed book exam. That’s hard enough.

🕣 Saturday

❔ Question 1 interpretation. What does enacted mean?

✔ Enacted means that you’ve already identified a recession and you have decided on and passed the appropriate policy response. The decision phase is over.

🕣 4:09 Saturday

❔ Can you review the ample reserves regime?

✔ We went deep into this last night. Because this email was sent before then, I think this has been answered, but the asker is here and is welcome to ask follow up questions or let me know they are still confused.

🕣 Saturday

❔ Will we have a chance to review PS6 before the exam?

✔ We could do 3:15-4:15 on Monday.

🕣 4:10 pm Saturday

❔Bruce said, “U.S. equities represent about 41% of world equities and a far smaller fraction of total world wealth.” Can you explain what that means more precisely?

✔ He is referring to market capitalization of the US compared to the entire world. The MC of the US is 41% of the market cap of the entire world.

Generally, when we speak of the size of the equity market, we are referring to the total market cap of all of the stocks in the market, so generally, the size of the stock market means the same thing as the market cap of the stock market.

🕣4:11 pm Saturday

❔ Can you review the equations on exchange rate from the last class? Some of that flew right over my head but probably because it was the first time I was seeing it.

✔ Yes, we’ll do this when we do the concept/page review later.

🕣 Saturday

❔ PS5 Q7 (there is NO shortcut :( Would we really be asked to do this on an exam?

✔ We’ll cover this during the solutions review.

🕣 Saturday

❔ PS5 Q13 - why is this uncertain and not true? Is this an error?

✔ We’ll cover this during the solutions review.

🕣 Saturday

❔ PS5 Q13 - Shouldn’t this be true? After all of that explanation, I didn’t think the answer was “uncertain”?

✔ We’ll cover this during the solutions review.

🕣 Saturday

❔ Is the only way to do a Duration problem with those spreadsheets on Excel? Why did I think there was a shortcut?

✔ Covered during last night’s review session.

🕣 Saturday

❔ Currency example?

✔

✏️Suppose you invest in Alibaba in China. While you are invested, the shares rise by 25%, but the renminbi falls by 12%. What is your total return?

✔ Approximate return: 25% - 12% = 13%

✏️Suppose you invest in Alibaba in China. While you are invested, the shares rise by=25%, but the exchange rate falls from to

ie ¥1 per .15. What is your total return?

✔ Percent appreciation in the renminbi:

%Δ¥ = (.15-.18)/.18 =-0.16666666666

Our approximate return is 25%-16.66666666%=8.333333%.

Let’s see if we can calculate this in one step using the following equation:

25% + (.15-.18)/.18 = 8.333333%

✏️ Now suppose that you could have invested the same money in Google and would have earned 12%. How much better is the domestic investment?

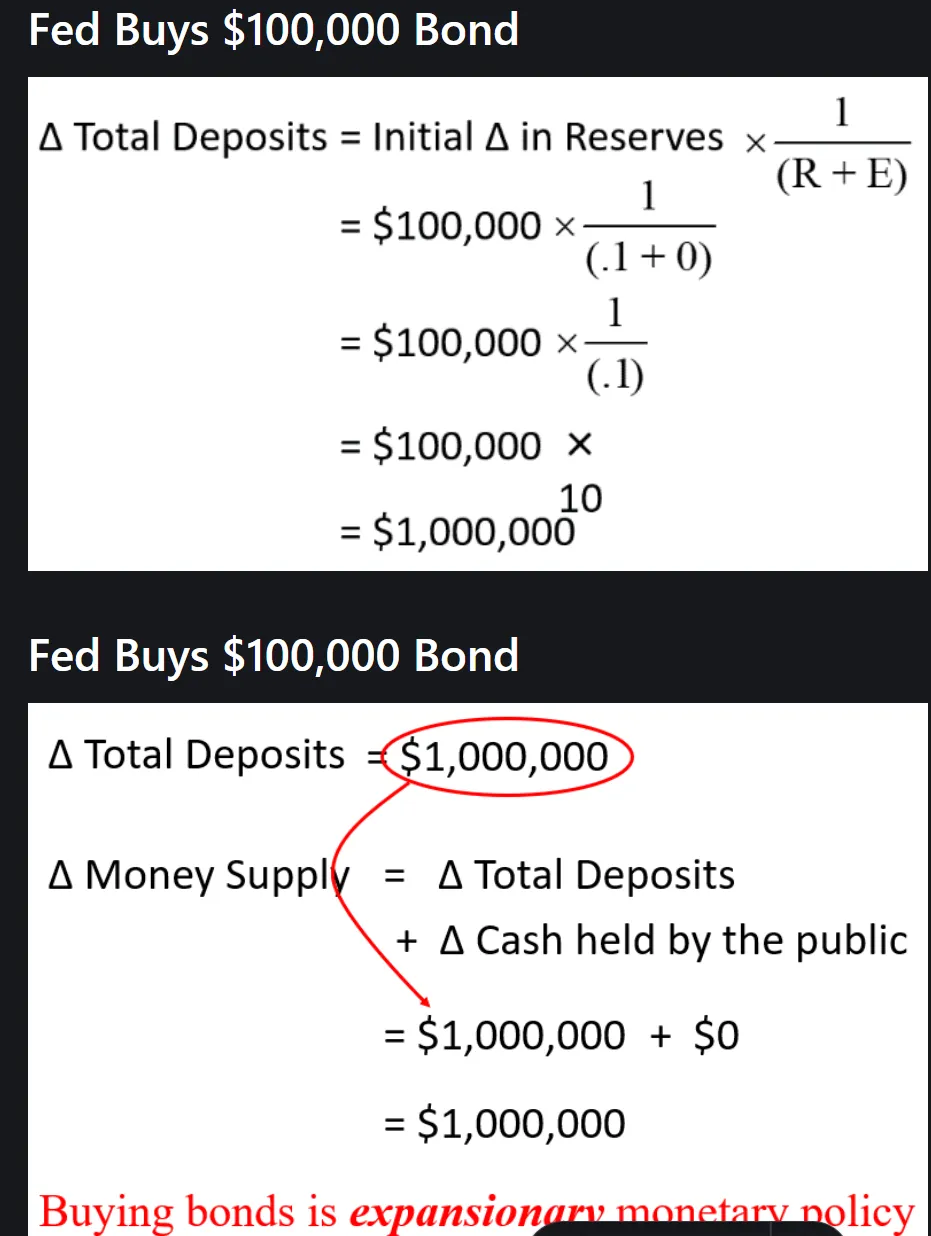

✔ For this, we use the full ugly formula:

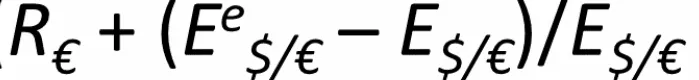

We’ll use the top version, because we’ve been using versions of it throughout.

(We can just copy the formula down from above.)

12% - (25% + (.15-.18)/.18 ) = 3.666666%

Approximate return: 25% - 12% = 13%

📅 Questions covered Sunday, Aug 4

🕣 3:49ish Sunday

❔ Can you do some interest rate parity problem where you solve algebraically for different quantities.

✔

✏️ Suppose that R$=7%, Ee$/€ = 1.1, E$/€=1.05. What is the R€ that would make this make sense?

✔

Using interest rate parity.

R = R€ + (Ee\/€ -E$/€)/E$/€

7% = R€ + (1.1 -1.05)/1.05

You don’t need to worry about multiplying by 100 to get a percentage if you think of 7%=.07

.07 = R€ + (1.1 -1.05)/1.05

.07 - (1.1 -1.05)/1.05 = R€ = 0.022381=2.2381%

.07 = 2.2381% + (1.1 -1.05)/1.05 = .07

✏️ Suppose that R$=7%, R€ =2.5%, E$/€=1.05. What is the future expected per € exchange rate (Ee\/€) that the market appears to be anticipating?

✔ R = R€ + (Ee\/€ -E$/€)/E$/€

7% = 2.5% + (Ee$/€ -1.05)/1.05

.07 = .025 + (Ee$/€ -1.05)/1.05

.045 = (Ee$/€ -1.05)/1.05

.045*1.05 = (Ee$/€ -1.05)

.045*1.05 +1.05= (Ee$/€ ) = 1.09725

🕣 3:43 Sunday ❔ How do I tell how much time I have left? Do I need to submit in advance?

✔ in video

🕣 Sunday

❔ I am not sure you can answer this but on PS6, don’t we have to flip the exchange rates so they are exchange rate in dollar/foreign currency and not the other way listed in the PS?

✔ To figure out if you need to flip the exchange rates (ie take the reciprocal) just ask yourself whether you have “dollars per unit of foreign currency” or “units of foreign currency per dollar.”

✏️ Suppose that you can exchange 1000 KRW for 1 USD. What is E/₩ = 1/1000 = .001

Takeaway:

- Read the / as the word “per.”

- There should be 1 of the currency after the /. This wasn’t the case here, so we had to flip it.

dollars per unit of foreign currency, which is the one we use in our formulas E$/₩. I suspect it will be like this most of the time.

✏️ Suppose that you can exchange $.001 for ₩1. What is E/₩ = .001

As you can see, I can make mistakes too, so just go slowly, understand the concepts deeply, and make sure everything makes sense.

🕣 4:05 Sunday

❔ I am also confused because it is not clear which version of the formula to use - you confused me when you said there is an error with the equation on the slides about whether it should be + or - when adding the R (foreign current ) + or - the percent change. Is it plus or minus? That really threw me off.

✔ I don’t recall saying there is an issue on the slides. Just check my formula sheet.

🕣 Sunday

❔ How do we determine which sign to use on the equation? - on one slide Bruce has a + sign, and on the other larger exchange rate formula for the foreign rate of return, it’s a minus sign. If I use the version with the + sign, I am not getting any of the options for one of the questions…and I know he never has that answer choice where it is none of the above.

✔

✔ Bruce tries to make the questions themselves as simple as possible. You do have to understand the material deeply and the material is tricky, but the questions themselves are meant to be more straightforward to interpret. Some will definitely still be hard, but that is because the material is hard and they require a deep understanding and/or they require you to integrate different ideas in a single problem or problem solve. However the interpretation is meant to be straightforward.

Students sometimes lose time and misinterpret questions by overthinking, so just be aware of that danger and try to catch yourself if you might be overthinking. Sometimes the simplest interpretation is the correct one.

🕣 Sunday

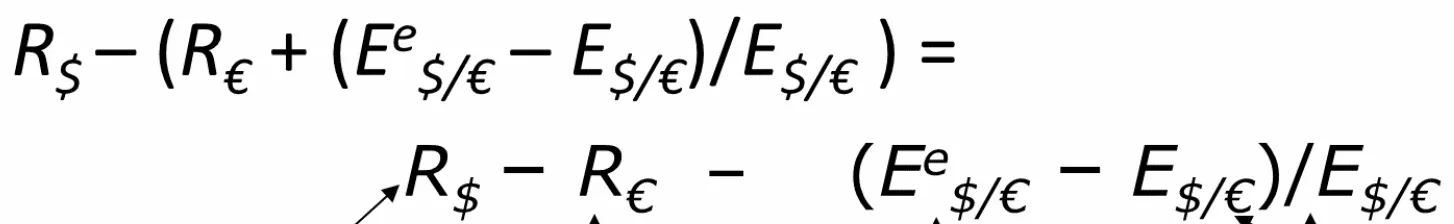

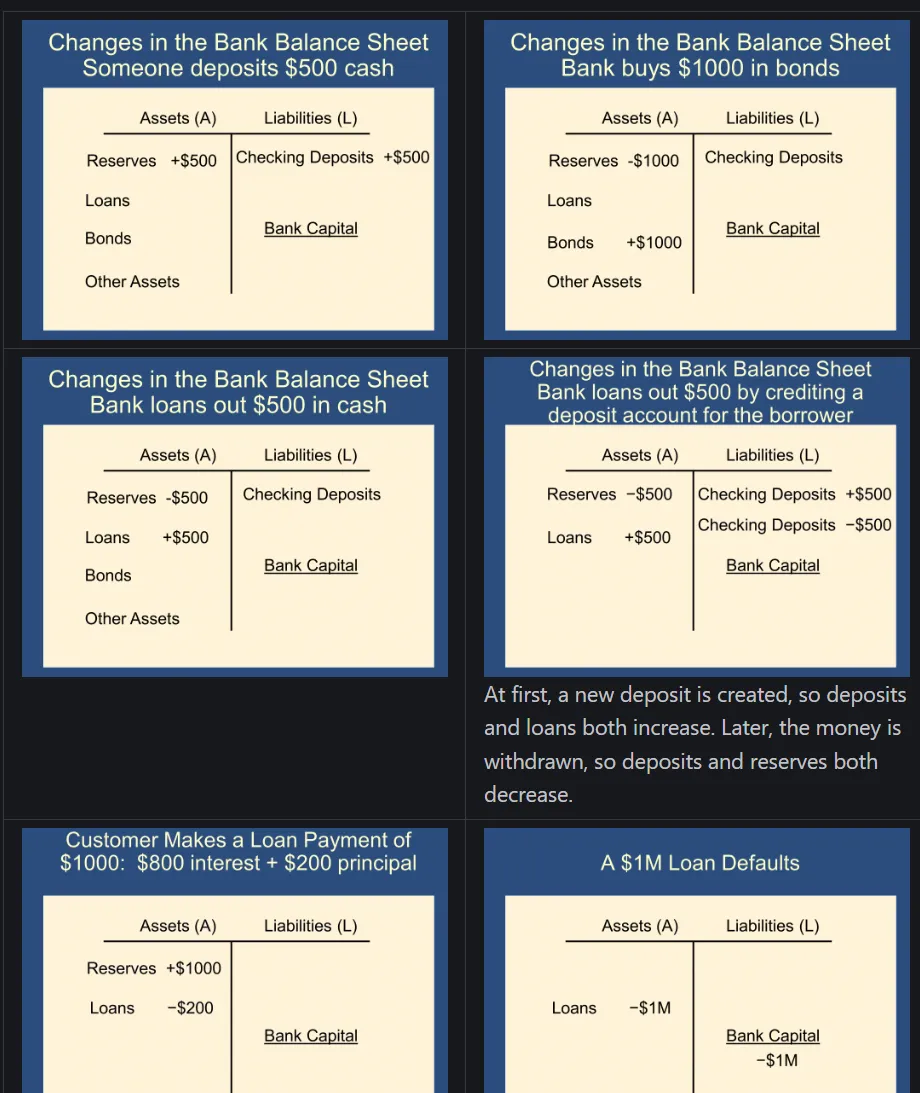

❔ Are there any numerical questions in monetary policy?

✔

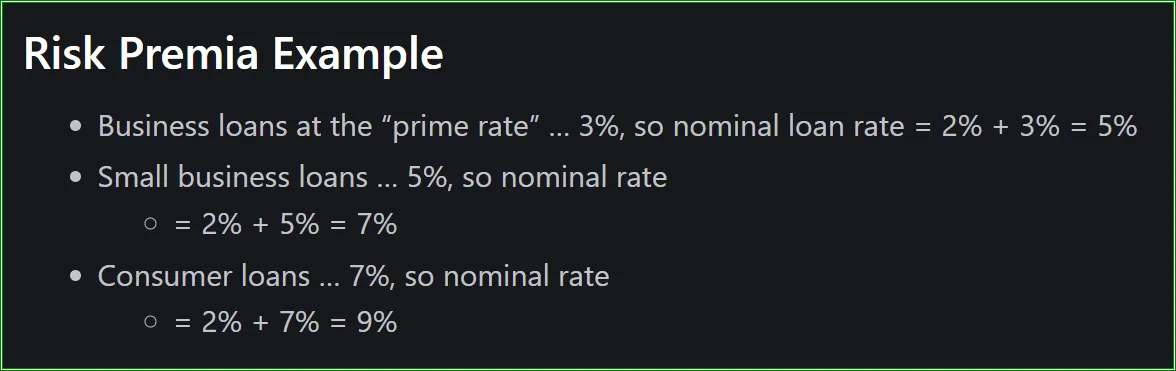

Quantitative repo examples should involve an interest rate.

Quantitative repo examples should involve an interest rate.

🕣 3:42 Sunday

❔ Did you say you updated the formula sheet?

https://canvas.harvard.edu/courses/140153/discussion_topics/1057780

https://1452.robmunger.com/formulas/

✔ Covered this in the video.

🕣 Sunday

❔ Can you direct me to an example to show how to do YTM on Excel - which specific function to use and what goes in each place? He has an example in lecture, but I am playing with the different options on Excel and not getting it.

✔

There is a spreadsheet here: https://1452.robmunger.com/l6/bondsspreadsheet/

s1452 Help Links: 👨💻

- General Info on sections and using this website.

- Email office hour questions to robecon1452@gmail.com. PS1Q2=“Question 2 of Problem Set 1”

- Slides with handwriting from section and other useful files